Accra, Ghana//-Ghana Stock Exchange (GSE) says it has deepened talks with the State Interest and Governance Authority (SIGA) to soon get some 12 or more State Owned Enterprises (SOEs) listed.

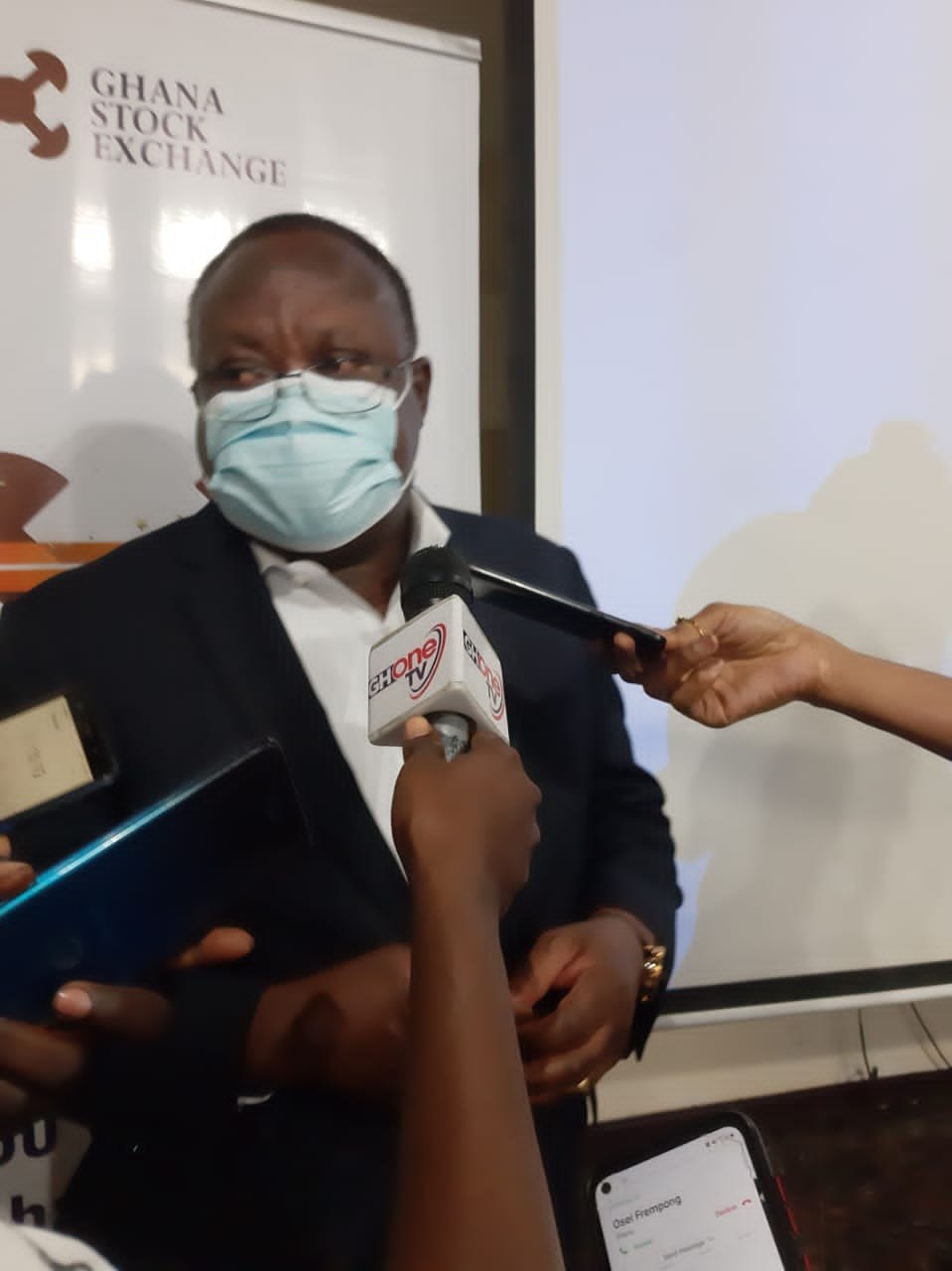

The Managing Director of GSE, Ekow Afedzie who said this at a programme dubbed-‘Time With Ghana Stock Exchange’, added that the discussions were far advanced to yield positive results.

According to him, by listing on GAX or the main GSE these SOEs could mobilize millions of Ghana cedis to enable them turnaround their operations at this critical time as the country struggles to weather the storm of the deadly COVID-19 pandemic.

The Ghana Alternative Exchange (GAX) is a parallel market operated by the GSE with focus on Small and Medium Enterprises (SMEs) with growth potential.

It is high time for the SOEs to take advantage of the GSE which recorded the highest trading activity in its 30 years existence last year to issue securities on the local bourse, Mr Afedzie urged.

He also encouraged the SOEs to see the GSE as the right platform for selling shares to the public, saying: “The GSE is ever ready to support any SOE which wants to sell equity on the market”.

Benefits of listing

Mr Afedzie emphasised that the benefits of listing on the GSE outweigh any other channel of mobilising capital in the country, stressing that the state-owned corporations can have access to ‘cheap money’ to turn things around.

The interest cost of listing debt securities are relatively lower, he stated.

Another benefit of listing on the stock exchange is to spread the risk of ownership among a large group of shareholders.

Therefore, if these SOEs are listed on the GSE their level of risk would be reduced “, Mr Afedzie added.

Furthermore, SOEs and other companies that list on the GSE have additional leverage when obtaining loans from financial institutions, he said.

He also acknowledged that having a security listed on an exchange affords the SOE or a company increased credibility with the public.

While having the SOE or the company indirectly endorsed through having their securities traded on the exchange.

Additionally, having a SOE’s securities listed on an exchange could attract the attention of pension funds, mutual funds, unit trusts and other institutional funds. So, SOEs listing on the GSE should be encouraged by all, Mr Afedzie indicated.

Shares and employee share option programmes can be offered to potential employees, making the SOE or the company attractive to top talent.

Key to better SOE performance is good corporate governance that provides the regulatory framework for acceptable practice, strategic direction and sound business judgement. Therefore, listing these SOEs on the GSE is another way of assuring good corporate governance.

In 2017, the government announced that it was considering listing many struggling SOEs on the GSE to enable individuals and corporate entities own shares in them. It is part of the overall drive to reform the sector and help them achieve commercial success.

A recent report by the Ministry of Finance covering 77 SoEs revealed that they made a net loss of GH¢3.12 billion in 2018 as against GH¢1.2 billion in 2017.

According to the 2018 State Ownership report, this represented 150.49 percent deterioration in the net loss posted by the SOEs from 2017 to 2018.

Why SOEs not listing

Mr Afedzie attributed the country’s SOEs low interest in listing on the GSE and GAX to low education, unfavourable economic condition, and the lack of information.

For instance, a lot of people are not aware that the GAX exists and they can raise capital. They are not aware of the benefits they stand to gain when they get listed, they are not aware of the incentives that we have put in place, he stressed.

As part of the incentives, initial processes including underwriting and advisory service costs are free.

The second challenge is general, that the economy itself did not favour equity investments so people are putting more funds into money market investments, so it wasn’t good timing to bring SOEs and other companies onto the GAX. Now it looks like things are stable that is why the GSE is the best performing market in the world this year, according to experts.

He however debunked the erroneous impression that some companies are not listing on the GSE because of the strict requirements.

“It is not because of the requirements that Ghanaian companies are not listing on the GSE. It is rather Ghanaians don’t want people to know their wealth”.

Mr Afedzie who was led his mangers including the Deputy MD, Madam Abena Amoah, organised by the Institute of Financial and Economic Journalists (IFEJ), admitted that the process of listing on the GAX and the GSE is long.

But he said most companies in Ghana could meet the requirements.

Bond market

The Head of Ghana Fixed Income Market at the GSE, Augustine Simons used the event to announce that the GSE would soon issue green bonds.

He therefore encouraged companies in the country to take advantage of the upcoming green bond market.

SOEs

As SOEs are primarily owned and led by government, government departments, agencies and boards of companies are partners in providing corporate governance to ensure their success. But this is missing in most SOEs operating in the country. This is why most SOEs are struggling to survive in the West African second largest economy.

SOES are legal entities which are created by the government in order to partake in commercial activities on the government’s behalf. They are common worldwide.

In Ghana, Volta River Authority, Ghana Water Company Ltd, Electricity Company of Ghana, Ghana National Gas Company Ltd, Ghana Railway Company, Produce Buying Company and Ghana Airport Company are few examples of SOEs. Majority of these SOEs are struggling.

By Masahudu Ankiilu Kunateh, African Eye Report

Email: mk68008@gmail.com