August 16, 2017//-The financing needs of Africa related to the Sustainable Development Goals (SDGs) are enormous, amounting to at least US$600 billion a year. As both external and domestic debt are growing, how can Africa finance its development aspirations and maintain debt sustainability?

In 2015, the international community adopted an ambitious global development agenda aimed at eradicating poverty, protecting the planet’s environment, and ensuring prosperity for all.

This vision is encapsulated in the Sustainable Development Goals (SDGs). Along with implementing Agenda 2063, Africa’s own continental development vision, achieving the SDGs is one of the major development aspirations of the continent.

The financing needs related to the implementation of the SDGs and Agenda 2063 are immense. Schmidt-Traub estimates that the incremental costs of financing the SDGs in Africa amount to more than US$600 billion per year.[1] This amount equates to almost one third of Africa’s aggregate gross national income.

But this may be a conservative number, as estimates differ depending on the method used. Chinzana et al. estimate the required GDP growth rate to achieve SDG 1 (ending poverty) and the corresponding investment-GDP ratio and financing gap-GDP ratio, assuming that savings, official development assistance (ODA), and foreign direct investment remain at current levels.

According to this method, an annual GDP growth rate of 16.6 percent per year will be required, along with additional investment of US$1.2 trillion per year, to meet SDG 1 only[2].

The level of growth and financial resources required for realising the SDGs will be challenging to achieve. After more than a decade of unprecedented growth in Africa, the economic conditions have been rapidly changing and look less favourable. The steep decline in commodity prices, the slowdown of Chinese demand, and unstable international financial markets are likely to negatively impact Africa’s growth prospects.

Moreover, the global development finance landscape has evolved, as reflected in the outcome document of the Third International Conference on Financing for Development, the Addis Ababa Action Agenda. There is a shift from a model centred on ODA and the coverage of remaining financing needs through external debt, to a framework with greater emphasis on the mobilisation of domestic resources.

At a time when debt levels are rising and donor funds have become scarcer, these changing economic and financing conditions raise concerns on how Africa can finance its development aspirations and maintain debt sustainability.

Scale of the debt exposure in Africa

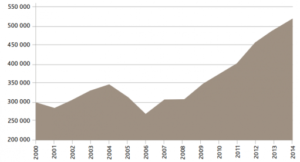

Following the decline in debt burdens through debt relief, external debt is again on the rise in Africa. During the period 2011-2013, Africa’s external debt stock grew by an average of 10.2 percent, as compared with 7.8 percent in 2006-2009, with an annual average of US$443 billion in 2011-2013. While external debt as a share of GNI (22 percent in 2013) appears to be manageable, its rapid growth is a concern.

Figure 1: Africa’s external debt stock, total (million current US$), 2000-2014

Source: World Bank, International Debt Statistics

The composition, terms, and conditions of external debt are changing and getting tougher, especially for the heavily indebted poor countries (HIPC). First, the share of concessional financing declined in two thirds of the HIPCs in Africa from 2005-2007 to 2011-2013.

Second, these countries have experienced a marked, steady decline in the maturity and grace period of new external debt commitments on average since 2005. The average interest on their new external debt commitments has also worsened, although it remained below the average for non-HIPCs in Africa, as well as for low-income countries. Third, public and publicly-guaranteed debt from private creditors has not only risen in both HIPC and non-HIPC, but has also become more diversified.

As of November 2015, the IMF classified nine out of 39 African countries for which data are available as being in debt distress or at high risk.[3] This includes Burundi, the Central African Republic, Chad, Djibouti, Ghana, Mauritania, Sao Tome and Principe, Sudan, and Zimbabwe.

Countries are considered in debt distress when they are already having repayment difficulties, and they are classified in the high risk category when the baseline scenario and stress tests indicate a protracted breach of debt or debt-service thresholds.

The rise in external debt is occuring for two main reasons. First, the more than a decade of strong economic growth has provided many African countries with the opportunity to access international financial markets. As interest rates were low owing to quantitative easing policies and the issuance of government bonds by developed countries in response to the financial crisis, African countries could borrow when it was relatively cheap.

Second, and more recently, the decline of commodity prices has led to reduced export revenues, a widening current account deficit, and slower economic growth. Several African countries recurred increasingly to external borrowing to balance their fiscal accounts.

Domestic debt is also on the rise, albeit from a low level. This development has been driven by the need to fill the gap created by a decline of ODA as a share of total external flows, and robust economic growth accompanied by low and stable inflation, which created conditions for developing domestic debt markets.

Some countries have adopted specific policies to, for instance, build their bond markets with the active support of international financial institutions. Africa also made progress in financial sector development and access to banking services, and several local currency debt markets are opening up to non-resident investors.

The analysis of the evolution of domestic debt in five countries (Ghana, Kenya, Nigeria, the United Republic of Tanzania, and Zambia) shows that domestic debt increased from 11 percent of GDP in 1995 to around 19 percent at the end of 2013.

Furthermore, these countries recorded an increase in marketable versus non-marketable domestic debt, and succeeded in building domestic capital markets through broadening participation beyond traditional holders (central and commercial banks) and in issuing local-currency-denominated debt securities with long maturities.

Their ability to issue long-dated instruments is closely related to general macroeconomic conditions and the emergence of large institutional investors such as pension funds and insurance companies.

While the broadening of the investor base offers new sources of available finance and lowers the risk of crowding-out, it also means that new risks arise as the number of creditors and debt instruments expand. Hence, debt becomes more difficult to manage and requires greater institutional and statistical capacity.

A major concern with regard to domestic debt lies in its interest costs relative to external debt. On average, the aforementioned five countries face a much heavier interest burden on local-currency-denominated domestic debt compared with external debt.

This, however, needs to be assessed with a critical eye as the cost of servicing external debt can greatly increase if the local currency depreciates. As the currencies of many African countries continue to be exposed to exchange rate risks, this factor is still an important source of vulnerability.

How to keep debt in check

Maintaining debt sustainability and securing sufficient funding to finance the SDGs requires responses, processes, and policies at the national and international level.

There should be a distinction in terms of the use of debt. When debt is used for strengthening productive capacities and spurring structural transformation, it contributes to a country’s economic resilience, long-term capacity to prosper, and also its ability to service debt.

On the contrary, if debt is used to finance consumption or recurrent expenditure, the borrowing tends not to generate long-term benefits or enhanced capacity to service debt.

To reduce commodity dependence and achieve structural transformation, African countries need to implement policies that foster economic and export diversification. This will reduce their vulnerability to shocks and expand their sources of public revenue.

Ensuring that debt is used productively requires sound investment programmes that contain carefully selected projects as well as effective mechanisms to identify bottlenecks and support timely project implementation, thus guaranteeing project quality and viability.

The use of debt should also be recognised as a criterion when assessing debt sustainability. The existing joint World Bank-IMF Debt Sustainability Framework (DSF) should make adjustments or afford more flexibility to debt channelled to productive investments related to the SDGs than to debt used for consumption.

The DSF could also be improved through implementing temporary payment caps on debt service for low-income countries. This would mean that debt service payments would be limited, and that beyond the threshold, payments to all creditors (including commercial creditors) would be proportionally reduced.

African governments need to weigh the benefits and risks of external and domestic debt. Regarding external debt, several countries have experienced a rapid increase, especially in comparison to their GDP growth rate. In these cases, and where external debt as a share of GDP is already high, actions to contain debt growth are required so as to avoid a recurrence of the debt crisis of the late 1980s and 1990s.

With the rising share of non-concessional debt and the move towards commercial funding and higher integration into global capital markets, debt monitoring and debt management capacity should be strengthened. This new complexity of financing options requires a new skill set geared towards private financial markets that government officials may not have developed yet.

There is also a need to systematically collect data on domestic debt, as this will help countries to improve the quality of their debt database, and thus contribute to better transparency and accountability, debt reporting, and debt sustainability analysis.

Complementary modalities of finance

Given the complexity of Africa’s development challenges and the scale of its development finance needs, African countries need to leverage all possible sources of finance.

UNCTAD’s Economic Development in Africa Report 2016 suggests that African countries should tap into diaspora savings and make greater use of remittances, which reached US$63.4 billion in 2014. Diaspora savings could be attracted through diaspora bonds, foreign-currency-denominated deposits and syndicated loans with remittances as collateral.

These mechanisms, however, require the use of formal remittance channels; hence, efforts should be undertaken to facilitate and lower the cost of formal remittance channels.

Governments should also try to leverage resources from the private sector, for instance through the use of public-private partnerships (PPPs). While PPPs are complex contractual undertakings and bear borrowing risks, they can offer access to specialised skills, technologies, and innovation from the private sector.

These factors can lead to greater operational efficiency and thus better quality and competitiveness of public services. To avoid that the contingent liability of PPPs turns into a debt burden, governments must strengthen PPP frameworks and regulation at the national and regional levels.

This requires legal, managerial, and technical capacities to clarify the roles and responsibilities of contracting partners, provide clarity in case of litigation, plan and monitor implementation effectively, and carry out robust investment appraisals and financial analysis.

Finally, together with the global community, Africa must tackle illicit financial flows (IFFs), which deprive Africa from important resources for development. Between 1970 and 2008, Africa lost an estimated US$854 billion in IFFs, roughly equal to all ODA received by the continent during the same period.

At the international level, cooperation in tax matters and IFFs should be sustained and enhanced. At the national level, capacities of public revenue authorities should be strengthened in various areas, particularly with regard to tax issues and detailing and curtailing IFFs.

Conclusion

Africa’s financing needs are enormous and require African governments to carefully evaluate their financing options and how they impact on debt sustainability. History has shown that there is a fine line between sustainable borrowing and debt distress.

While external debt as a share of GNI is currently at a manageable level in most African countries, the ratio has been rapidly increasing in several countries.

Moreover, owing to the decline of the share of concessional debt, the increase of interest rates, and the shortening of maturities and grace periods, the external debt burden of heavily indebted poor countries is likely to increase. Caution is hence warranted.

Case studies suggest that there is, however, scope to further deepen domestic debt markets. To monitor new investors and flows, enhanced debt management capacities are needed. It is also recommended that owing to the scale of its financing needs, Africa should consider and assess all possible options to access additional finance, including complementary modalities of finance such as PPPs or instruments to attract diaspora savings.

Tackling these debt management challenges will require strengthened institutional capacity at the national level and supportive international cooperation.

This article is based on UNCTAD’s Economic Development in Africa Report 2016: Debt Dynamics and Development Finance in Africa.

Authors: Claudia Roethlisberger, Economic Affairs Officer, Division for Africa, Least Developed Countries and Special Programmes, UNCTAD. Junior Davis, Chief of the Africa Section, Division for Africa, Least Developed Countries and Special Programmes, UNCTAD.