A panel of investors and banks has ruled Ghana’s missed coupon payments on its foreign denominated bonds counts as a failure-to-pay event, paving the way for a payout of the default-insurance contracts tied to the country’s debt.

The Credit Derivatives Determinations Committee (CDDC) made the decision at a meeting held on Monday, March, 6, 2023, according to a notice on the panel’s website on Friday, March 3, 2023.

Ghana skipped payment of interests on January 18, 2023 of a $1 billion Eurobond maturing in 2026.

The missed payment triggered a 30-day grace period, which eventually expired at the end of the day on February 17, 2023.

The ruling triggers the payout of the insurance protection on Ghana’s sovereign debt.

Credit-default swaps covered a gross $66.4 million and a net $34.4 million of Ghana’s debt as of February 10, 2023, according to data from the Depository Trust & Clearing Corp.

The nation’s Eurobonds were unchanged following the decision, with the majority of the notes trading at a discount of 60-65% versus their face value, according to CBBT pricing compiled by Bloomberg.

The swaps panel had already ruled in January that Ghana’s decision to suspend debt servicing on its eurobonds, commercial term loans and most of its bilateral debt met the definition of a “potential repudation/moratorium.” This happened before the grace period on the first missed payment had expired.

What influenced this action by investors?

It is not clear how Ghana’s recent decision to freeze its payment and engage the Eurobond Credit Committee over the Debt Exchange Programme, couldn’t influence the action of the investors.

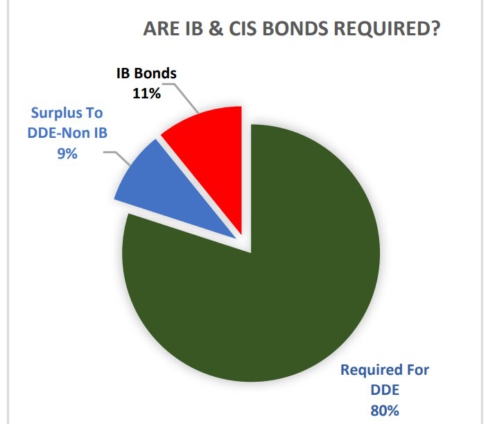

Some analysts have argued that government’s decision to embark on the Debt Exchange Programme should have prevented the investors and commercial banks from taking the actions.

The Finance Ministry has announced that it will pay coupons on the bonds that didn’t receive payments in the Debt Exchange Programme by March 13, 2023.

Bloomberg