The year 1873 marks a turning point in monetary history. In July, the new German Empire Reichstag replaced an array of silver-based currencies with the gold mark.

In September, the Paris mint limited silver coinage, ending the double gold-silver monetary standard France had maintained for decades. And earlier that year, the US Congress legislated the phasing out of the temporary paper currency of the Civil War years, to replace it with a gold dollar once the government resumed specie (coin) payments (which happened in 1879).

With the United Kingdom already on gold, by the end of the 1870s all the world’s leading industrial nations used gold currencies. Silver—which, until 1873, had been on an equal footing with gold—became a secondary currency metal used mostly by periphery countries.

The monetary impact was stark. Between 1873 and the end of the decade, silver depreciated by some 20 percent relative to gold, after having traded at stable exchange values for 70 years. Gold countries experienced severe deflation that lasted until the early 1890s.

The real repercussions are more difficult to assess because comprehensive national accounts for the 1870s are lacking, but indicators such as industrial production point to a severe and long recession in several countries—in Germany, for example, the post-1873 years are known as the Gründerkrise (a period of crisis).

Global bimetallism

Nineteenth century currency systems operated very differently from today’s monetary system. Money was tied to precious metals (bullion). Coins (specie) were minted from bullion, and paper money could be exchanged for bullion at guaranteed exchange values.

In the early 19th century, most countries tied their currencies to silver—except the UK and, beginning in the mid-1830s, the US, which were on gold. France tied its currency to both gold and silver: per an 1803 Napoleonic law, the French mint paid 200 francs for a kilo of silver and 3,100 francs for a kilo of gold.

France’s double price guarantee established global bimetallism: it ensured not only a stable exchange value of 15½ between silver and gold but also quasi-fixed exchange rates between all countries on gold and silver currencies.

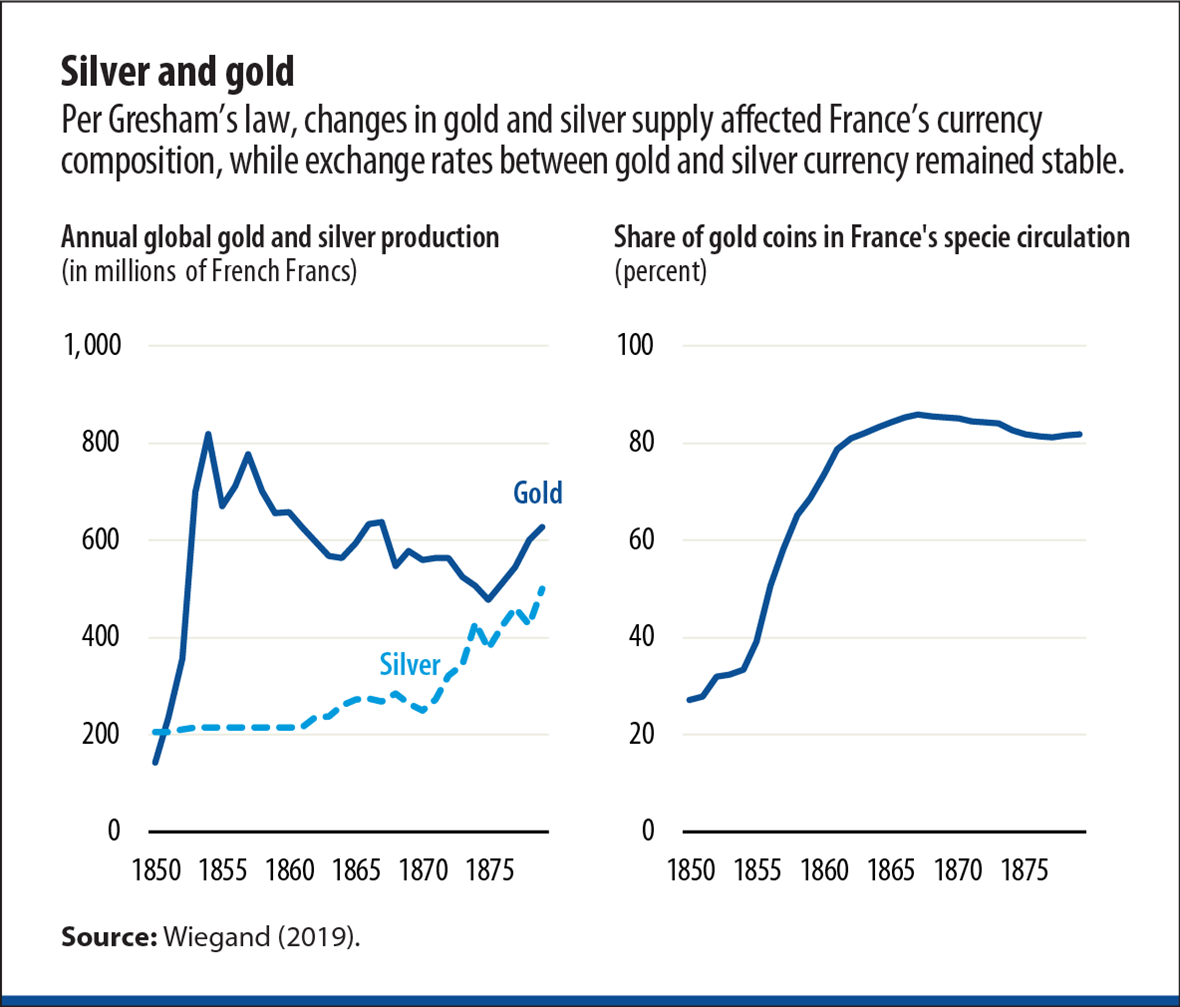

Global bimetallism worked as long as both gold and silver coins circulated in France. France would then operate as a global monetary stabilizer: through a mechanism called Gresham’s law, changes in the global quantities of gold and silver translated primarily into changes in France’s currency composition, while exchange rates between gold and silver currencies remained stable. Moreover, bimetallism was better at stabilizing prices than a regime based on only one currency metal, as supply shocks to gold and silver partially offset one another.

Gresham’s law

“Gresham’s law” states that, in fixed exchange rate systems, “bad money drives out good.” In the case of bimetallism, it worked as follows: the mint fixed the relative price of two currency metals. If the supply of one metal increased—for example, because of new discoveries or currency reforms that demonetized that metal—its market price would tend to fall, generating an incentive to bring bullion (raw metal) to the mint and convert it into specie (coins) to take advantage of the price guarantee.

Conversely, the other, now scarcer (and therefore relatively more valuable), metal would be withdrawn from circulation. Changes in bullion supply therefore shifted the composition of specie in favor of the cheaper, “inflationary” currency metal, as long as the mint’s price guarantee was effective. This monetary principle is named for Sir Thomas Gresham, financial agent of Queen Elizabeth I.

Global bimetallism operated seamlessly until about 1850. Then, large gold discoveries in California and Australia increased global gold production by a factor of 5. Per Gresham’s law, the share of gold in French specie surged—from less than 30 percent around 1850 to more than 85 (!) percent in the mid-1860s.

It gradually dawned on currency experts that this was a dangerous development for bimetallism. If gold crowded out silver entirely from French specie, France would become a de facto gold country. The bond between gold and silver currencies would break, and the world would split into gold and silver blocs, triggering potentially violent movements in exchange rates and prices.

Concerns ran especially high in Germany. Most German states used silver currencies. Without the bimetallic bond, Germany would find itself on a different monetary regime than the world’s leading economies—the UK, the US, and France—and would trade with them on floating exchange rates. Economists and businesses feared this would demote Germany to a periphery economy. And not everyone in France was happy with bimetallism either, especially with the fluctuations in specie composition that France had to endure.

Bimetallism in the 1860s

Given these strains, how did bimetallism survive the 1860s? In 1867, Emperor Napoleon III hosted an international monetary conference in Paris to seek alternatives. It issued a nonbinding recommendation for a global currency system based on gold. France itself seemed to be leading the world away from bimetallism.

Making a recommendation was one thing; however, implementing it was another—not least for France itself. Moving to gold required getting rid of France’s silver coins. But silver would devalue once the bimetallic bond was dissolved and silver demonetized—by abandoning bimetallism, France would impose a loss on itself (Flandreau 1996).

In Germany, a growing sea of voices demanded replacement of silver with gold or a bimetallic currency. But the German states could shed silver coins only if someone exchanged them for gold—and in the bimetallic system, this “someone” could only be France.

According to Gresham’s law, German reform would trigger a large increase in French silver circulation. Would France tolerate this? Or would it cut the bimetallic bond to avoid getting swamped with silver—and bring about the very outcome German pundits feared: monetary isolation? German policymakers were left guessing and did not advance currency reform beyond preliminary steps (Wiegand 2022).

In short, in the 1860s there was no easy way out of bimetallism. France both controlled and was hostage to the bimetallic system: it could deter other countries from changing the system’s parameters, but it could not end bimetallism itself without incurring significant costs. Hence bimetallism prevailed. Markets placed remarkable trust in the arrangement and treated gold- and silver-based assets as near-perfect substitutes (Flandreau and Oosterlinck 2012).

Germany’s reform

The setting changed fundamentally in 1870. A Prussia-led German coalition won the Franco-Prussian war, triggering Napoleon III’s downfall, the emergence of the Third Republic, and the formation of the German Empire.

Prussian troops occupied Paris and would withdraw only once France paid a large indemnity (more than 20 percent of French GDP), which was payable in silver, among other things. France could not abandon bimetallism now, as demonetizing silver would undermine its capacity to pay and regain sovereignty.

This meant policymakers in Berlin had free rein to pursue currency reform—but only until France settled the indemnity. Hence Germany acted quickly, even hastily. In July 1871, the Berlin mint suspended silver coinage.

A few weeks later, the federal government began buying gold in London, and in early December, the Reichstag passed a law authorizing gold coinage. The federal and regional governments brought the new gold coins into circulation simply by spending the indemnity (without withdrawing silver coins first). Hence specie circulation surged, unleashing a large (and short-lived) fiscal-monetary stimulus. The Reichstag formally adopted the gold standard in July 1873.

One may wonder why Germany adopted a gold and not a bimetallic currency—prior to 1870, bimetallism had enjoyed considerable support among German economists.

But Germany’s specie circulation was too small to sustain global bimetallism on its own: it needed France to maintain the bimetallic bond, both before and after settling the indemnity—otherwise Germany would be thrown back on silver. Monetary cooperation had already failed in the 1860s; however, it seemed even less probable in the aftermath of armed conflict.

Hence Germany moved all the way to gold: it was the only choice that avoided monetary isolation regardless of France’s decisions (Wiegand 2019). And Germany was not alone: the Scandinavian countries and the Netherlands also used the window of opportunity to switch from silver to gold.

Breaking bimetallism

On September 5, 1873, France settled the indemnity’s last installment—two bond issuances of hitherto unknown volume (the Rente Thiers) had allowed much earlier payment than originally anticipated. The next day the Paris mint limited silver coinage, and therefore broke the bimetallic bond.

This move was unexpected. France could have sustained bimetallism even after the German, Dutch, and Scandinavian currency reforms if it had accepted a higher share of silver coins. Why then expose itself and the world to monetary instability?

The measure appears so self-destructive that Flandreau (1996) suspected revanchism as the motive. Ending bimetallism harmed France—but it harmed Germany even more, as Germany sat on an even larger pile of silver that could now be sold only at a loss.

An intriguing interpretation has been proposed by Velde (2002). France could have upheld bimetallism in the early 1870s—but its absorptive capacity was not unlimited.

Beginning in the early 1870s, discoveries in America’s West boosted global silver production (see chart)—and according to Gresham’s law, this silver would eventually find its way into French specie, crowding out gold. And what if even more countries abandoned silver currencies and sought to unload obsolete silver on France?

The tide had turned: it was now France that had to fear monetary isolation on silver should bimetallism end. Faced with this prospect, pulling the plug early while France’s silver holdings were still small—and Germany’s large—seemed better than waiting and ending up with a large silver pile for which the rest of the advanced world had no use.

Consistent with Velde’s interpretation, France did not end bimetallism abruptly. Instead, the Treasury stressed that limits on silver coinage were temporary and could be lifted once excessive silver inflows stopped: a weakly concealed invitation to Germany to reconsider its reform.

Only when these efforts failed did bimetallism’s demise become irreversible. In early 1875, markets concluded that the bimetallic bond was gone, and in 1876, France suspended silver coinage entirely. The classic gold standard was born.

Aftermath

It is almost forgotten that the gold standard’s early years were rough. In the new gold bloc, persistent deflation drove up real interest rates that weighed on profits and investment. Distributional conflicts between debtors and creditors erupted and poisoned the political atmosphere.

It soon dawned on the public that the monetary decisions of the early 1870s had something to do with this. Bimetallic lobby groups formed and demanded the resurrection of the old monetary regime. International conferences in 1878, 1881, and 1892 discussed the issue, but as in the 1860s, they failed to come up with results.

Another inflection point arrived in July 1886, when a prospector in South Africa’s Witwatersrand region found a rock that contained traces of gold. It turned out to be part of an enormous gold deposit.

The ensuing gold boom dwarfed even the earlier Australia and California gold discoveries. The gold fed into the money supply, allowing liquidity-strapped economies to reflate rapidly. As deflation came to an end, debt concerns weighed less heavily.

The belle epoque began, a period of rapid economic, technological, and cultural development that lasted until World War I. Prosperity boosted the gold standard’s reputation: tying a currency to gold became synonymous with sound monetary management. Hence, after World War I, policymakers sought to restore the gold standard—tying the “golden fetters” that would later amplify the Great Depression.

Lessons

Bimetallism operated smoothly as long as the financial environment was stable and only one country—France—needed to sustain it. When the going got tougher, maintaining bimetallism would have been beneficial, but it would have required international cooperation—and cooperation failed miserably.

While today’s monetary system operates very differently from that of the 19th century, monetary stability remains a global public good, which requires international cooperation. Monetary stability shares this basic feature with all global public goods, from securing peace and stability to safeguarding the world’s climate.

By Johannes Wiegand

JOHANNES WIEGAND is an advisor in the IMF’s Strategy, Policy, and Review Department.

JOHANNES WIEGAND is an advisor in the IMF’s Strategy, Policy, and Review Department.