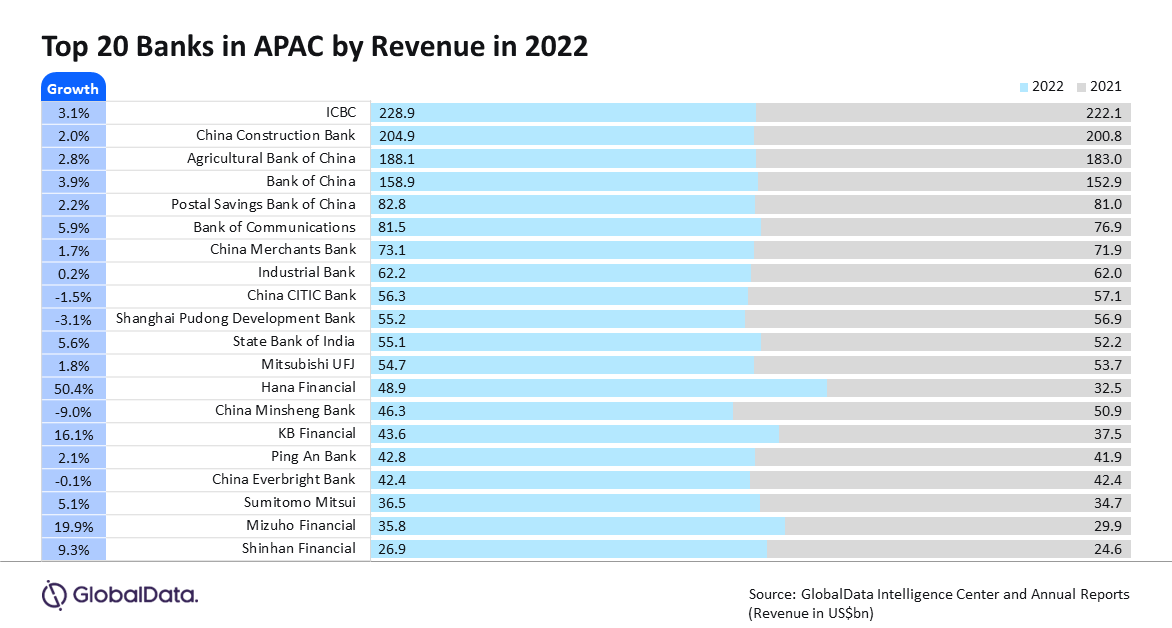

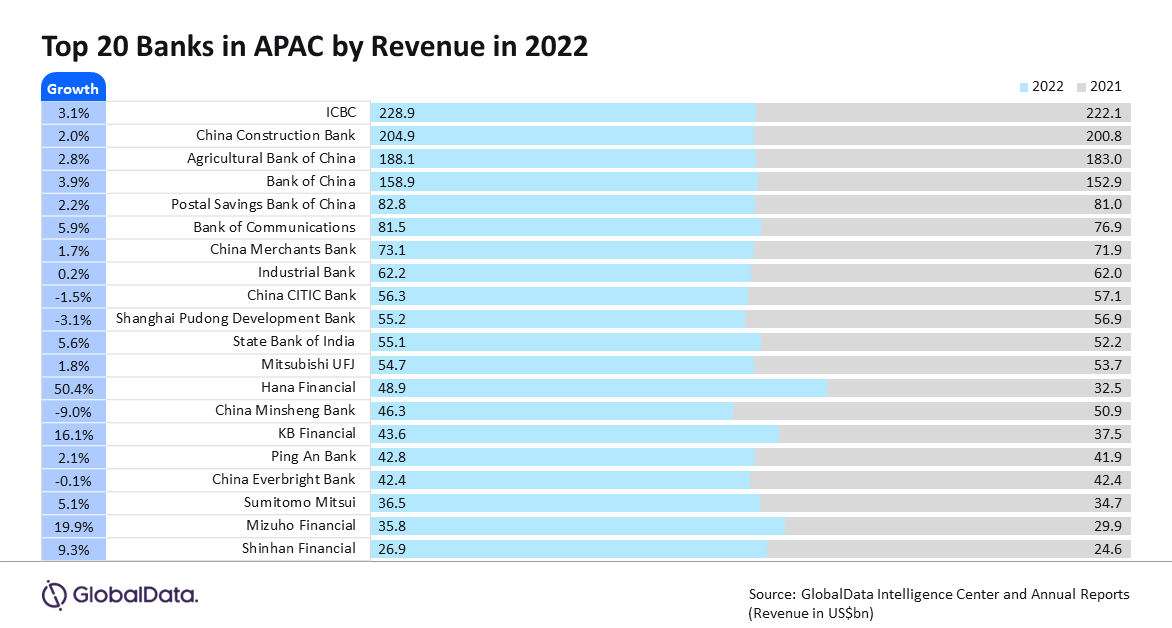

The revenue growth of top Asia- Pacific (APAC) banks was impacted by extended lockdowns and the real estate crisis in China.

In addition, the banks faced challenges from high inflation, interest rate hikes, and geopolitical issues. As a result, the aggregate revenue of the top 20 APAC banks increased by 4% to $1.6 trillion in 2022, compared to 11.4% growth in the previous year, according to a study by GlobalData, a leading data and analytics company.

Murthy Grandhi, Company Profiles Analyst at GlobalData, said: “Out of the top 20 banks, 13 were from China, and they reported a meagre 0.8% average revenue growth, due to extended lockdowns, weak credit demand, and real estate crisis.”

According to GlobalData, only three APAC banks were able to record double-digit revenue growth in 2022, and two of them were from South Korea – Hana Financial (50.4%) and KB Financial (16.1%).

Hana Financial’s impressive growth was due to a 46.1% growth in interest income, while it recorded a marginal 3.1% rise in fees and commission income. Mizuho Financial registered a 19.9% increase in revenue owing to an 8.1% rise in fee and commission income from securities-related business.

KB Financial also reported growth in its interest income by 36.7%, thanks to a booming loan portfolio, which could absorb a 3.8% decline in its fee and commission income from its securities business.

The top Chinese bank in 2022 was Bank of Communications, which reported 5.9% growth in revenue on the back of a 9.6% rise in interest income from loans and advances to customers, which had offset a 5.6% decline in fee and commission income due to a decline in wealth management business and agency services.

With a 5.5% decline in interest income, a 43.1% fall in trust and other fiduciary services, and a 14.8% drop in agency services, China Minsheng Bank was the worst performer among the top 20 banks in APAC.

Grandhi concluded: “2023 has brought its own new challenges for the banking sector, including an evolving geopolitical landscape, the US regional banking crisis, the UBS-Credit Suisse merger, weakening credit demand, and stagflation. With these headwinds, the top APAC banks are likely to continue to face growth challenges.”