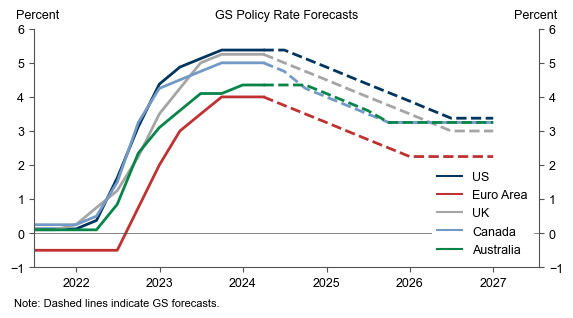

1. The G10 monetary easing cycle is broadening. Following the recent moves by the Swiss National Bank and the Swedish Riksbank, we expect the ECB, BoE, and BoC to start cutting rates in June.

The pace of easing is likely to be gradual because prices and wages are still growing faster than implied by central bank targets in every economy except Switzerland and unemployment remains near pre-pandemic levels in every economy except Sweden (in fact, it stands at a multi-decade low in the Euro area).

Nevertheless, G10 central banks increasingly think that a policy rate which looked appropriate 6-12 months ago no longer looks appropriate now that the inflation emergency has passed.

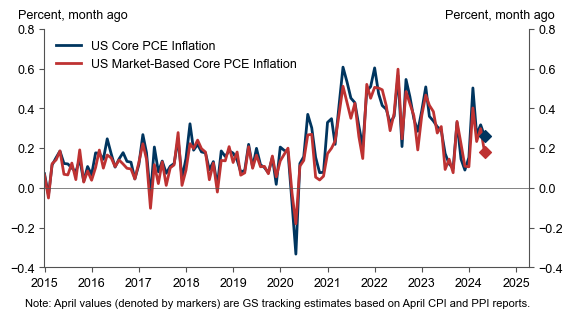

2. The Federal Reserve will not be in the first wave of cutters because of the pickup in sequential core inflation during Q1. How much of the damage was undone in April is a matter of perspective. Using CPI, PPI, and import prices, we estimate that core PCE increased 0.26% month-on-month, a pace well below the 0.36% average of the prior three months but probably not sufficient for a July cut if maintained in May and June. However, we also estimate that the market-based core PCE index—which was noted by Fed Chair Powell in a talk last week and which excludes imputed items such as portfolio management services and gambling—rose just 0.18%, a pace that would be quite consistent with a July cut if maintained. We continue to forecast cuts in July and November, but the timing remains sensitive to upcoming data.

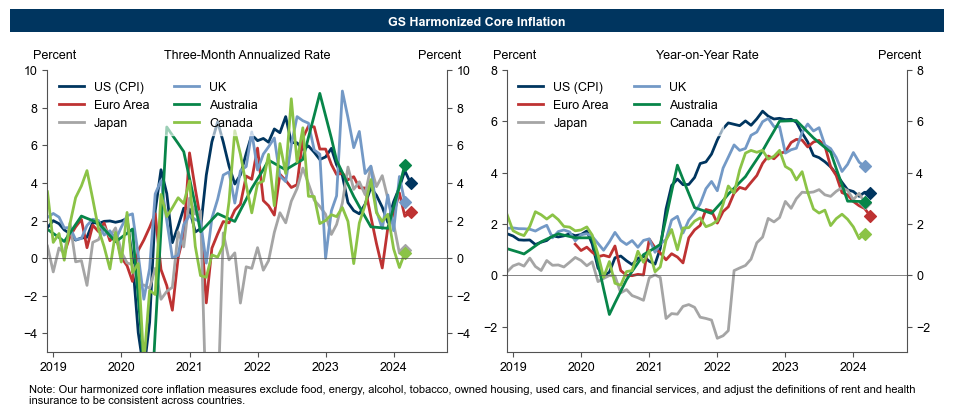

3. Stepping back from the monetary policy tactics and looking at the adjustment process more broadly, we think the United States is much less of an outlier relative to other G10 economies than widely believed. True, US sequential core inflation has outpaced other G10 economies since the start of the year on a harmonized basis.

However sequential inflation data are noisy and highly susceptible to seasonal adjustment distortions, especially in a post-pandemic environment. Thus, we would also put significant weight on the year-on-year inflation rate, which still shows the US near the middle of the range of G10 economies.

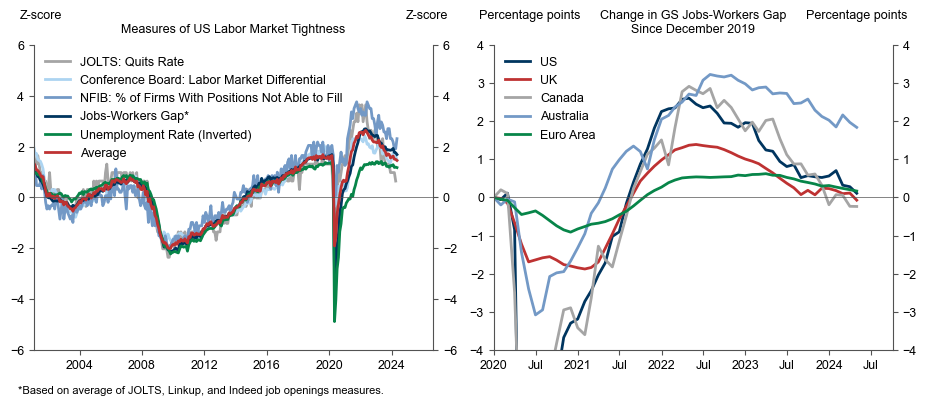

4. But hasn’t the US seen much faster growth? Yes, the 3% increase in real GDP over the past year is the strongest within the G10. But a different picture emerges when we look at labour market tightness—a more important driver of inflation and therefore a more appropriate target for monetary policy.

Despite the strength in GDP growth, overall US labour market tightness has returned to its pre-pandemic level, with a modest increase in the unemployment rate and ongoing declines in job openings, quits, and reported labour shortages. Moreover, the decline in the US jobs-workers gap also compares favourably with other G10 economies.

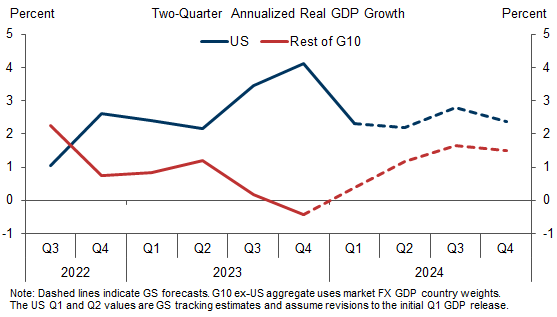

5. In any case, US growth outperformance has probably peaked. After the weaker-than-expected retail sales report for April, we estimate that US GDP growth will slow from 4.1% in 2023H2 to 2.2% in 2024H1. This would have looked quite strong before the pandemic but is now close to potential given the boost to labor force growth from the recent immigration wave. By contrast, we estimate that growth in other G10 economies will pick up from an average of -0.4% in 2023H2 to an average of +1.2% in 2024H1.

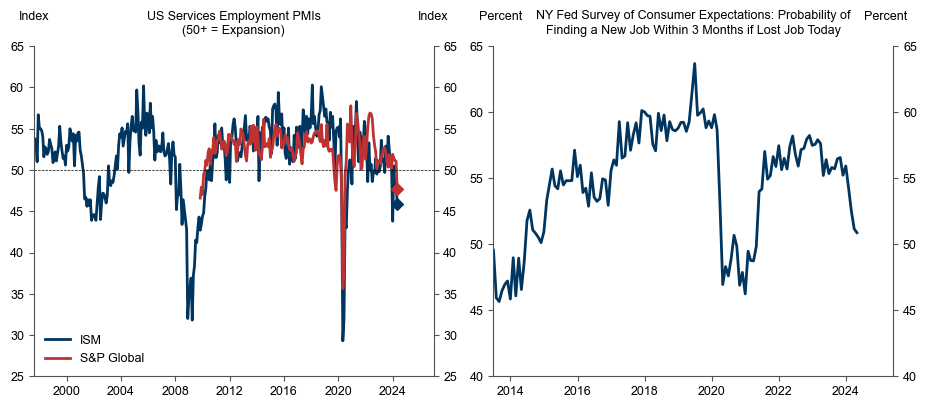

6. Not surprisingly given the weaker GDP numbers, there are now signs that US employment growth is slowing. Nonfarm payrolls grew only 175k in April, the unemployment rate rose to 3.9%, the jobs components of the ISM and S&P/Markit purchasing managers’ indices have fallen below 50, and the New York Fed Survey of Consumer Expectations shows a notable decline in job-finding expectations in the event of job loss over the past several months.

This suggests at least some risk that the labour market could slow more precipitously in the remainder of the year, which would likely result in more aggressive Fed easing than the two cuts we project in our baseline forecast. This is one reason why our probability-weighted Fed call skews slightly dovish relative to market pricing, despite the upside risks from tariff-induced inflation in a potential second Trump administration in 2025.

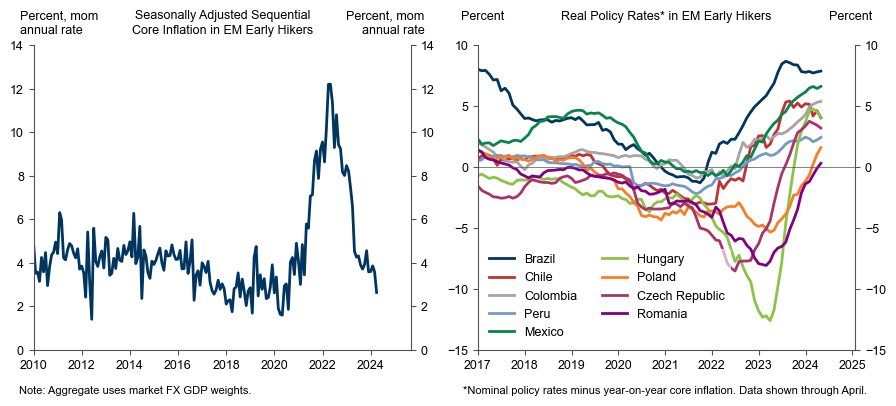

7. Whenever the Fed does cut, the biggest opportunities for investors may well come in EM rather than DM rates markets. The EM early hikers in Latin America and CEEMEA have seen continued good inflation news this year, with April core inflation making a new cycle low both on a sequential and year-on-year basis.

By cutting only tentatively so far, EM central banks have allowed real policy rates to rise into highly restrictive territory, even allowing for the uncertainty around neutral rates. This caution is understandable given the historical fear of depreciation vs. the US dollar but would probably evaporate quickly when the Fed starts to cut and might subside gradually even without Fed cuts.

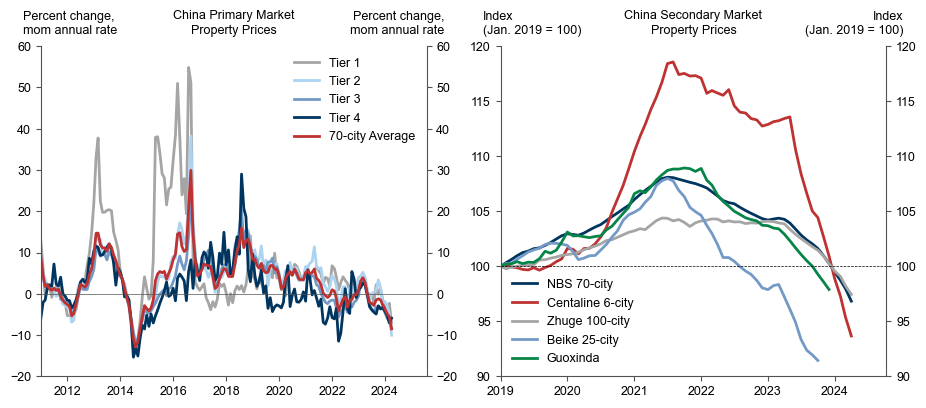

8. We continue to expect China’s GDP to rise 5.0% this year, slightly above consensus, but this masks a large and growing bifurcation between different sectors. Buoyed by robust exports, industrial production rose 6.7% year-on-year in April—the strongest pace since early 2021 and similar to the stellar growth rates of a decade ago, on a base that is now much larger.

In sharp contrast, home prices continue to plunge, with new home price declines accelerating to 8.5% on a seasonally adjusted month-on-month annualized basis in April and existing home prices down 5-20% over the past year depending on the data source. The weakness has prompted policymakers to roll out further easing measures, including funds to begin purchasing excess inventory, but we think much more is still needed.

9. Rates markets have recovered some of their prior losses on the back of incrementally better inflation news and weaker US growth. Our rates strategists expect yields to fall modestly further in coming quarters, but this will require continued benign data as yield curves remain significantly inverted.

Under our forecast that growth remains positive, our credit strategists expect spreads to move sideways from here, with moderately positive excess returns for the asset class in the remainder of 2024. Our US equity strategists expect prices to move sideways to slightly lower, partly because valuations are now very elevated and markets discount solid earnings growth. Our commodity strategists have continued to make the case for their $75-90/barrel range for Brent oil prices while predicting continued sizable gains in copper prices.