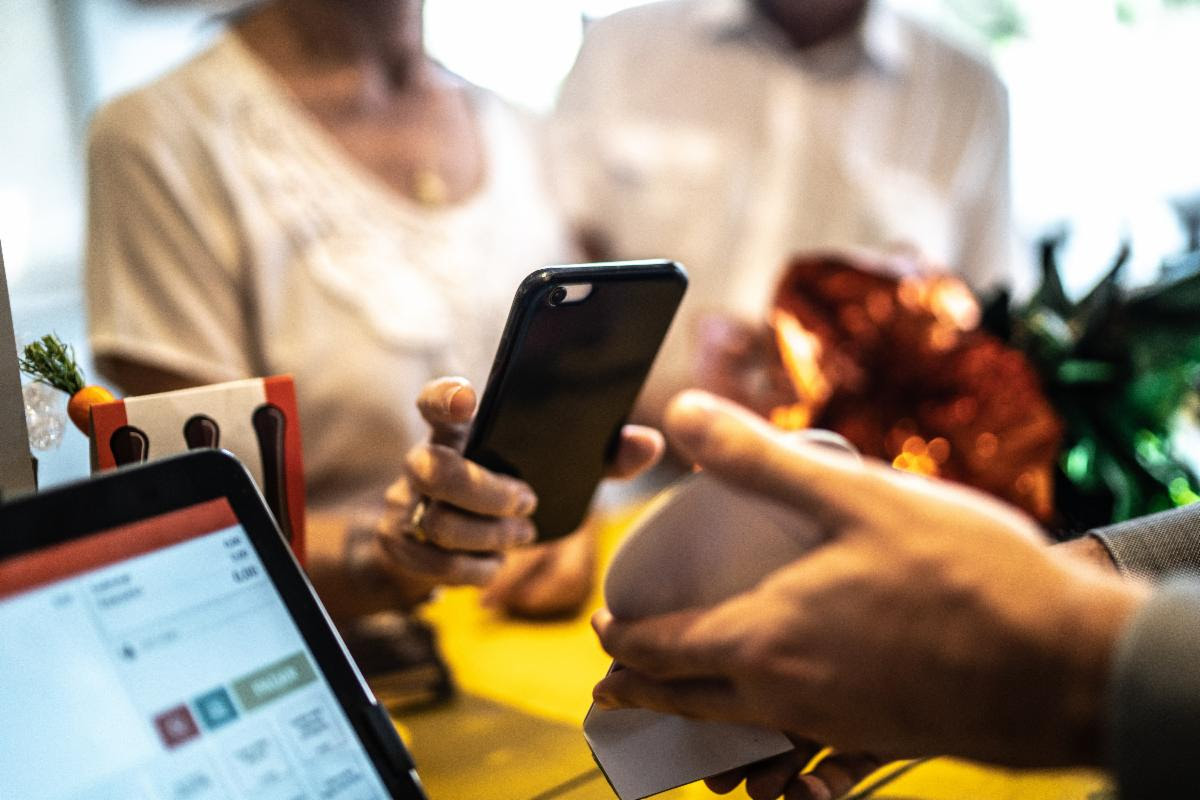

Accra, Ghana//-Several Ghanaian customers want to discontinue the use of digital payments due to the rampant activities of online fraudsters in the country.

The General Manager for Cellulant Ghana, Eric Kortey who disclosed this, added: “They will rather want to make payments in cash because of the fear of being defrauded. It does not happen to only those who are less literate, it happens to all of the literates too”.

In recent times, cases of mobile money or bank fraud have tripled, he stated.

For instance, the Bank of Ghana’s (BoG’s) latest data collated from the three sectors (banks, Specialised Deposit-Taking Institutions (SDIs) and Payment Service Providers (PSPs) revealed that GH¢26 million was lost to the country’s Electronic Money Issuers (EMIs) in 2022, representing about 103 percentage points growth in financial crime.

The data which was compiled by the Financial Stability Department of the BoG from 01 January– 31 December 2022 also noted that the recorded electronic-money (E-money) cases rose to149 in 2022, as compared to 116 cases in 2021, depicting an increase of 28.45% in year-on-year terms.

Kortey identified that the increasing rate of mobile money fraud and the fear of losing customers’ money, is one of the key barriers to digital payments in the country.

Mobile money fraud which is not peculiar to Ghana is also rampant in Kenya, Uganda, Tanzania, and other countries which are using the service for financial intermediation.

However, the fraudsters are exploiting the vulnerability of the identifiable loopholes in the country’s national identification system, greed, and ignorance on the part of the mobile money account holders, among others.

Sylvia Otuo-Acheampong, Head of Products and Services at MobileMoney Limited, a wholly owned subsidiary of Scancom PLC of MTN Group, said “… telling me about fraud is different from experiencing it. And you realize that even people who are educated fall victim to MoMo fraud because of the craftiness of how the fraudsters craft their messages”.

She continued: “They are also increasingly polishing their games. So, they make it sound real. We must keep on educating people and we can’t take that one out if we want to move fintech forward”.

The CEO of Eagle Innovations Ghana, Winifred Kutin blamed the rise in mobile money fraud cases on the low financial literacy and literacy rates in the country.

According to her recent reports Ghana’s financial literacy is at 32%. While the last census report in 2021 conducted by the Ghana Statistical Service indicated that 70% of Ghanaians were literate.

This means that the country still has 30% of the population who can’t read, write, and understand English, so they could easily fall prey to mobile money fraudsters.

What is being done to address mobile money fraud

Besides, sustained massive education campaigns on mobile money being waged by MobileMoney Limited and other mobile money services such as Vodafone Cash and AT Money, the Head of Fintech, and Innovation at the Bank of Ghana, Kwame Oppong assured that the bank was assiduously to clear the mobile money ecosystem out of fraudsters.

MobileMoney Limited (MML) which controls more than 75% of the country’s mobile money market is collaborating with the Economic and Organised Crime Office (EOCO) to fight the rising mobile money fraud cases.

To this end, a one-year Memorandum of Understanding (MoU) which is subject to renewal was recently entered between MML and the EOCO. It seeks to build the capacity of the staff of EOCO to properly investigate MoMo fraud cases in the West African country.

The executives of MML and EOCO pledged to work hard to stamp out MoMo fraud and other fraudulent activities.

The Executive Director of EOCO, CoP Maame Yaa Tiwaa Addo-Danquah, said: “If the criminals are working together, what about those of us who are fighting them? It is for that reason that we have been working together with MobileMoney Limited to stop mobile money fraudsters from defrauding our people”.

A month or two ago, EOCO got convicted for some mobile money SIM swamps where the criminals were swapping SIM cards and taking some money from people’s mobile money wallets.

Through collaboration with MTN the bankers’ association and others, the criminals were arrested and convicted after going through the necessary judicial processes.

Commenting on the MoU, the CEO of MobileMoney Limited, Shaibu Haruna stated that the MML would continue to collaborate with EOCO and other security agencies to ensure that mobile money is safe for all.

This he said because “mobile money has been an integral part of our daily lives as individuals, businesses and we are grateful to our consumers for supporting the growth of this business”.

MoMo transactions by figures

There is a growing usage of e-money among Ghanaians. The year 2022 recorded a value of GH¢1 trillion e-money transactions and the volume of e-money transactions stood at 5 billion, according to BoG.

In 2021, the value of e-money transactions stood at GH¢ 978.32 billion while the volume of e-money transactions stood at 4.25 billion, it added.

The use of mobile money has grown exponentially over the past decades, making Ghana one of Africa’s leaders in mobile money innovation, adoption, and usage.

As BoG noted, mobile money accounts now surpass bank accounts and greater financial inclusion has benefited large swathes of the population that remain unbanked including the poor, the young, and women.

While access to traditional banking services remains almost a mirage for most Ghanaians, the universal availability of mobile phones has allowed millions to access mobile money services in the country.

Most Ghanaian phone users now rely on mobile money to send and receive money domestically. Recently, they are taking advantage of new services to also send and receive money internationally.

MoMo services

The first mobile money operation was launched by MTN Ghana on July 21st 2009 to conduct two main services namely Money Transfer (P2P) and Airtime Purchase.

The platform now has six major categories of financial transactions under which varying services are provided. The services are pensions, insurance, savings, microloans, shopping, payments, international remittances, and banking/investment options.

Indeed, almost all the products and services of fintech platforms in the country are powered by MoMo payment services.

By Masahudu Ankiilu Kunateh, African Eye Report