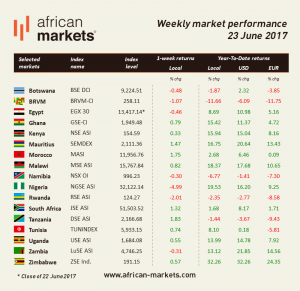

June 27, 2017//-A mixed performance this week on African markets with seven of the markets under our watch closing on negative territories.

June 27, 2017//-A mixed performance this week on African markets with seven of the markets under our watch closing on negative territories.

The JSE gained 1.32%. Comments made by two South African officials made news this week. Dondo Mogajane, South Africa’s new National Treasury Director General gave his first public comments since his appointment in the beginning of this month.

His ambition is to pursue reforms to support the economy and improve the country’s credit ratings. He stated that: “The economy needs to encourage more competition, generate jobs and keep the cost of living low while focusing on fast and inclusive growth”. He expressed his willingness to change the current state of the economy and said that current management in National Treasury is up for the challenge.

In a press conference, Public Protector Busisiwe Mkhwebane recommended to change the central bank’s mandate stating that the primary objective of the South African Reserve Bank should be to promote balanced and sustainable economic growth, rather than to target inflation. The legislative assembly along with the central bank itself and lender Barclays Africa are opposing this recommendation and are effectively seeking a court review. The parliament believes the mandate change, which is binding in terms of the law, usurps the powers of the institution under the Constitution. Mkhwebane comes less than a week after mines minister Mosebenzi unexpectedly raised the minimum threshold for black ownership of mining companies to 30% from 26%.

The MSE gained 0.82%. After completing its ninth and final review of Malawi’s economic performance, the IMF has stated that the economy was on the right track. This allows the fund to make a $26.9 mn loan to the country. Malawi’s finance minister expects the loan approval to potentially lead to more global lenders unlocking budget support that was put on hold three years ago over a corruption scandal in which public servants tapped millions of dollars from the public finances.

Uganda’s central bank decreased its key lending rate to 10% on Monday from 11%, stating a stable exchange rate for the shilling and subdued domestic demand had contributed to an easing of core inflationary pressure. The USE gained 0.55%.

The EGX30 lost 0.46%. According to a decree published in the official gazette on Thursday, Egyptian President has signed off on a stamp duty to be implemented on transactions carried out on the Egyptian Exchange for both buyers and sellers.

The stamp duty, which is effective immediately, has been set at EGP 1.25 per EGP 1,000 for the first year and will rise to EGP 1.5 and EGP 1.75 in the second and third years of implementation, respectively. El-Sisi further ratified extending the freeze on the capital gains tax for three years, according to the decree.

In 2014, Egypt declared a 10% tax on capital gains to increase the government’s tax revenues which it postponed for a two-year period in 2015 following pressure from investors. Under the decree issued this week, the freeze has been prolonged for another three years.

In Tanzania, the government has amended the Electronic and Postal Communications Act, 2010 with a view to allowing investors to take part in Initial Public Offerings for telecommunication companies.

East African citizens and companies as well as those operated by people from outside East Africa will now be able to buy shares in the coming IPOs. The DSE rose 1.83%.

Africanmarkets.com