September 29, 2018//-As the unfolding tariff war between the US and China looms ever larger, Africa finds itself in a bind as the world’s greatest superpowers vie for trade supremacy.

While some say that Africa will be forced to pick sides, Africa wisely shows signs of wanting to maximise both partnerships. Yet recent events show Africa moving ever closer to Beijing while Washington undergoes an apparent crisis of confidence in its approach.

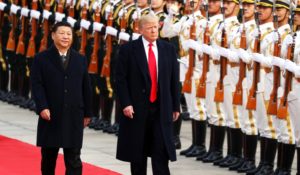

As the global competition with China unfolds, the US has become increasingly insecure about its influence in Africa. Watching President Xi Jinping roll out huge investment projects under the One Belt One Road initiative, Washington seems mired in delivering traditional aid and security packages to little fanfare.

America is still one of Africa’s most important trading partners and allies, but critics say its engagement looks old-fashioned when compared to China, Japan, India and the Gulf States, as the-european saids.

Meanwhile, President Donald Trump’s commitment to “America-first” protectionism and his obvious lack of interest in Africa show every sign of undermining existing efforts to build bridges with the continent.

Isaac Fokuo, founder of the Sino-Africa Centre of Excellence (SACE), describes how the US has faded from view. “Since China replaced the United States as Africa’s largest trading partner in 2009, its trade with the continent has soared by 83% from 2009 to 2011 and surpassed $200bn in 2013,” he says.

“By contrast, US trade with the continent reached an all-time high of $105bn in 2008 and has fallen ever since. China has woken up to the promise of African economies while the US appears sluggish.”

Debt fears

With little new to offer the continent, US officials, including President Trump, have expressed concern over China’s role on the continent. The concern, they argue, is that China’s many infrastructure projects are leading African economies to unsustainable levels of debt.

While debt levels are rising – Kenya’s for instance stands at 57% of GDP – the US may be more motivated by its own interests than a genuine concern for debt sustainability in Africa.

Indeed, this was all too clear during the recent trip of President Uhuru Kenyatta of Kenya to the White House where the US president cautioned Chinese debt dependency but simultaneously attempted to broker a huge infrastructure deal.

Trump proposed a $3.2bn contract for US construction firm Bechtel to build a Nairobi-Mombasa superhighway.

The Chinese built Nairobi-Mombasa Standard Gauge Railway (SGR) has only recently been completed at a similar price. The problem for the US, therefore, may not be the debt, but the fact that China’s largesse is buying it new friends among traditional US allies on the continent. In fact, critics say US concerns about Chinese debt traps are unfounded as most debt still belongs in the hands of Western players.

“The vast majority of debt issued by African governments is held either by international organisations like the IMF or Western holders. African debt is not high because of China as there are many different sources,” says John Ashbourne, senior emerging markets economist at Capital Economics.

Perhaps the US ought to focus on new policies before pointing to the flaws in China’s engagement. President Trump’s anti-trade rhetoric has spooked a number of countries on the continent, particularly those that benefit from the longstanding African Growth and Opportunity Act (AGOA), which provides tariff free access to the US market.

The US recently suspended long-term ally Rwanda from the act after President Paul Kagame increased tariffs on US-imported clothes in order to foster growth in the local garment industry.

Other countries may fear that their AGOA privileges hang by a thread when faced with the capricious President Trump. As if that wasn’t enough, Trump has also unwisely hit South Africa with steel and aluminium tariffs.

Furthermore, he has shown little wish to engage with the continent or introduce the kind of innovative pro-Africa legislation that his predecessors introduced and supported.

Feathering Chinese pillows

While the US flounders, China shows every sign of deepening its engagement with the continent. Debt concerns took a back seat when 48 African heads of state headed to Beijing for the third Forum for China-Africa Cooperation (FOCAC) in September.

During the forum, President Xi countered US criticism by offering debt relief to heavily indebted African countries along with pledges of $60bn in loans to help develop roads, railways, ports, pipelines and other trade links. China is now helping Kenya extend its SGR into a second phase.

Along with symbolic endorsements of Sino-African relations through media-heavy events such as FOCAC, African governments are moving their gaze east in a number of subtler ways. There is growing momentum on the continent for central banks to adopt the Chinese currency, the yuan.

The Central Bank of Nigeria recently sold renminbi for the first time after executing a $2.46bn currency swap with China. Fourteen African countries from eastern and southern Africa met in Harare earlier this year to mull the adoption. Patrick Njoroge, governor of the Central Bank of Kenya said it was “inevitable” that Kenya will include the Chinese yuan as a reserve currency.

Indeed, governors across the continent are looking to further tap into the Chinese market and are using yuan adoptions as a way to facilitate trade. “It shows a desire by African authorities to ease trade between China and African countries,” says Ashbourne. “In Nigeria, for example, you no longer have to transfer naira to dollars and dollars to yuan.” Although yuan percentages remain small in most African central banks, China’s willingness to engage with the continent – compared to the US’s increasingly outdated approach – may see this change in the future.

Tom Collins

This article was originally published on africanbusinessmagazine.com.