Since the Group of Twenty’s foundational Pittsburgh conference in 2009, progress toward its goal of strong, sustainable, balanced, and inclusive growth has been modest.

While G20 economies have shown remarkable resilience in navigating multiple shocks, medium-term growth prospects have moderated to just 2.9 per cent, the weakest since the global financial crisis. At the same time, disinflation remains incomplete for many, and public debt rose to a record 102 per cent of GDP last year. Furthermore, excessive external imbalances are widening again.

Still, there are encouraging signs. Our latest annual report to the group—whose members account for about 85 per cent of global economic output—points to some positive developments over the past year.

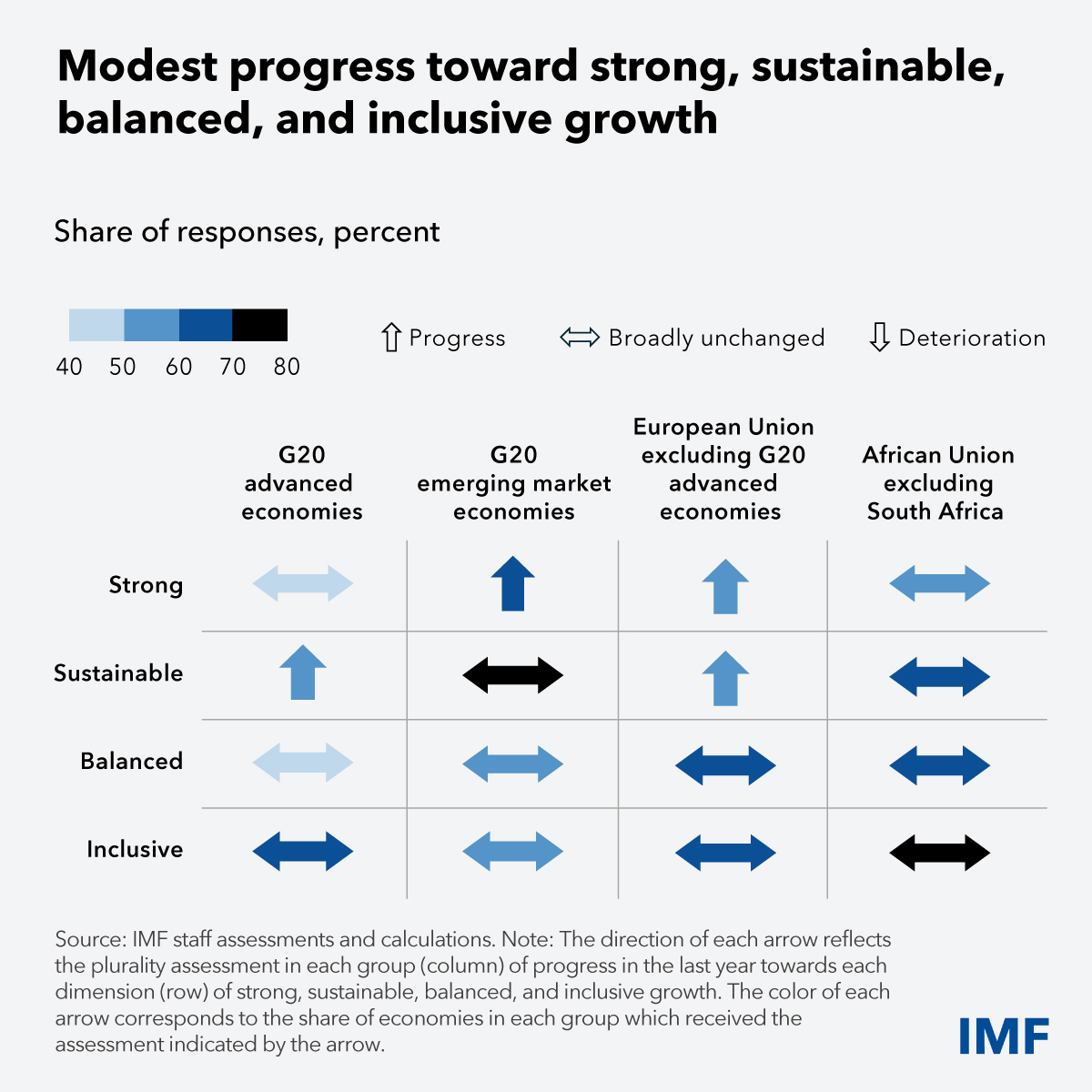

A survey of IMF country teams indicates that many G20 economies made progress toward stronger growth, including more than half of emerging market economies. Improvement has been substantial in some cases, such as Germany, where growth momentum was supported by reforms to fiscal rules.

Meanwhile, falling inflation and fiscal consolidation efforts are improving the sustainability of growth for most G20 advanced economies and half of the European Union.

But this is only part of the story. Progress over the past year has been somewhat muted along the final two dimensions:

- Balanced growth—without the buildup of internal or external imbalances, such as increasing reliance on one sector or on external demand—is proving elusive across the G20. Moderate deterioration was assessed in China and the United States because of widening excess current account balances.

- Inclusive growth—ensuring the economy benefits everyone—improved only slightly, particularly in G20 advanced economies and in the African Union, which joined the group in 2023.

With near-term uncertainty remaining high and an extensive list of headwinds, the outlook for securing strong, sustainable, balanced, and inclusive growth in the coming years is challenging. Against this backdrop, it’s more important than ever to reinforce momentum, even if it’s just tentative, across all dimensions of growth.

Smart fiscal policy is at the center of the challenge. Governments need to rebuild their fiscal buffers to contain rising debt, while meeting growing spending needs. Fundamental economic reforms are also needed to aid domestic rebalancing and foster stronger growth.

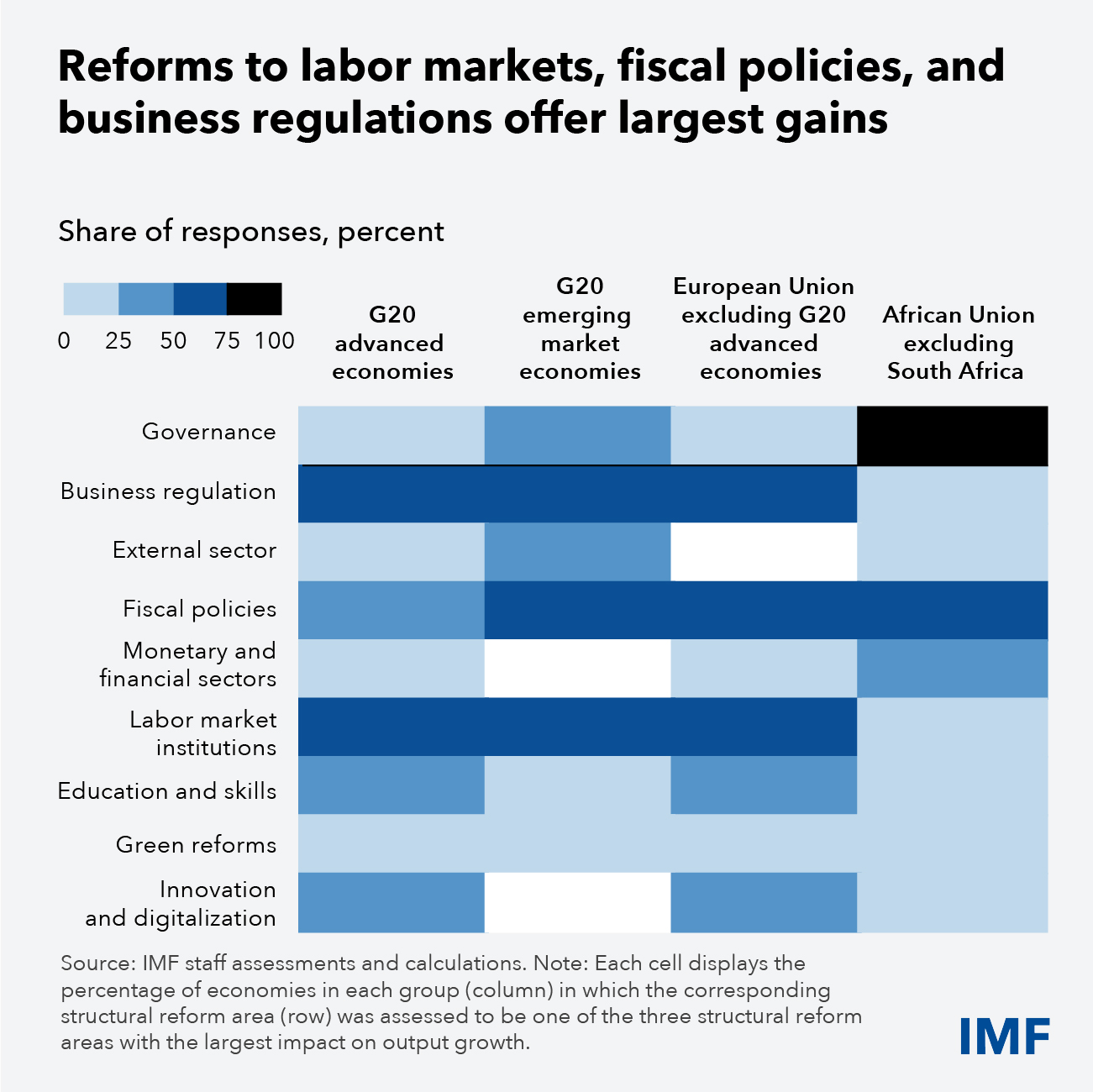

Of course, these structural reforms vary across countries. But to help guide prioritisation and sequencing, IMF country teams have identified measures with the highest expected growth impact. Reforms to labor market institutions, in addition to improved fiscal policies and business regulations, consistently ranked highest across the G20 and in the European Union.

For African Union members, the largest potential gains lie in foundational governance improvements, as well as fiscal reforms.

The payoff from concerted action by G20 economies would be significant. Simulations suggest that implementing the identified highest-impact structural reforms, alongside recommended macroeconomic policies, could raise growth across the group by about 7 percentage points cumulatively over the next decade. This would benefit emerging market economies the most.

Moreover, debt burdens would decline by more than 8 percentage points of GDP within five years for countries with limited fiscal space, reflecting the combined impact of recommended fiscal adjustments and structural reforms.

And these concerted reform efforts would also support domestic rebalancing by helping narrow current account balances, with large improvements possible for both major surplus and deficit economies.

Nicolas Fernandez-Arias, Shushanik Hakobyan

—This blog is based on the 2025 G20 Report on Strong, Sustainable, Balanced, and Inclusive Growth, prepared by IMF staff. For additional information, see also the new SSBIG dashboard.