Lagos, Nigeria, June 29, 2020//-United Capital Plc, a leading African financial and investment banking Group has called for innovative home-grown financing solutions to help strengthen Africa’s economic resilience in the face of the devastating COVID-19 crisis.

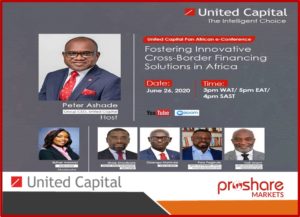

The Group CEO of United Capital, Peter Ashade who made this call at the maiden edition of United Capital Pan Africa E-Conference themed: ‘Fostering Innovative Cross-Border Financing Solutions in Africa’, maintained that this is the time for innovative home-grown financing solutions in Africa.

“The socio-economic impacts of the globally devastating COVID-19 has further exposed the vulnerabilities of the region as it continues to grapple with infrastructure development challenges compounded by capital flight to safer havens to mention a few”, Mr Ashade told the online viewers and his colleague panelists.

The panelists were- the CEO, Ghana Investment Promotion Centre, Yofi Grant; CEO UBA Benin; Gbenga Makinde; and a Director of African Development Bank, Wale Shonibare.

Obviously, this begs for innovative home-grown financing solutions to help strengthen Africa’s economic resilience and perhaps, propel the continent through a new phase of growth, Mr Ashade said.

“For us at United Capital Plc, we are contributing our quota as a responsible financial institution and reputable Capital Market operator by creating platforms such as this, where our distinguished panelists, comprising of the continent’s finest professionals, can proffer insights from their wealth of experience on how to change this narrative”.

He was confident that the participants would have gained useful insights on creating innovative financing solutions towards addressing Africa’s most critical challenges by the end of the conference.

Mr Makinde agreed with Mr Ashade that; “We need to look inwards to solve our problems and have currencies we can use to finance the challenges we have within”.

To this end, he said: “We need to adopt regional trade as a strategy to penetrate the African market; and if we have Pan African banks following this path, we will definitely proffer solutions within Africa”.

Mr Makinde who is the CEO of UBA subsidiary in Benin, stated: “Regional trade and financing is what has become the strategy helping us to penetrate the African Market”.

“We have to improve cross-border trade and also build regional interconnections; we also need to embrace one currency”, Mr Shonibare added.

He urged African leaders to put more effort to develop their local capital market and also invest in education.

“Under our Desert to power initiative, we’re creating the world’s largest solar zone to provide power to 250 million people”, Mr Shonibare, said.

Mr Grant noted: “Having different currencies within Africa is indeed a barrier and it is one of the critical things we need to look at; I should be able to trade in Nigeria with one currency because it is just one hour away.”

“We must take our minds away from cheap capital or cheap funding that takes us off the objective of we developing ourselves”.

Also, lack of capital goes with poor institutional growth and because most of our companies start from a microspace so it becomes difficult to make big leaps, hence we need great thinkers who are willing to look inwards”, Mr Grant, said.

Fola Fagbule, Senior Vice President of Africa Finance Corporation (AFC), the leading infrastructure solutions provider in Africa, observed: “The biggest constraint to capital formation in Africa is inflation”.

Over the years, cross border financing across Sub-Saharan Africa has played a limited role in effectively addressing the funding gap across key economic sectors in the continent.

For instance, FDI flows from China have surged from $0.5 billion in 2003 to $43 billion in 2017. Meanwhile, France, Netherland, the US, and the UK remained the largest investor economies in Africa with over $60 billion investment each as at 2017.

Contrary wise, data on intra-regional investment is scarce. However, the AfDB estimated that between 2006 and 2016, intra-African greenfield investments grew from $4 billion to $10 billion, while the number of intra-regional M&As doubled from 238 deals in 2006 to more than 418 in 2016. While this progress is laudable, so much more is still required.

African Eye Report