September 30, 2020//-With the world firmly in the grip of COVID-19, merchants everywhere are changing to adapt to the new reality.

September 30, 2020//-With the world firmly in the grip of COVID-19, merchants everywhere are changing to adapt to the new reality.

In order to facilitate social distancing and limit the spread of the virus, merchants are re-designing store layouts, expanding delivery options, and, when possible, pivoting to digital channels.

In addition to these changes, a major area of focus has been payment methods. Contactless payments—including QR code-based payment methods—are on the rise, with consumers increasingly avoiding cash and other payment options that require touching point-of-sale (POS) terminals.

To learn more about QR code adoption in the United States and what benefits this touch-free payment method offers, PaymentsJournal sat down with Kia Lee, VP of Strategy & Development at InComm, and Raymond Pucci, Director, Merchant Services at Mercator Advisory Group.

Unpacking the growth of contactless

One of the more documented trends in consumer expectations has been the widespread desire for convenience, immediacy, and choice in nearly all aspects of a consumer’s commercial life. From browsing online to checking out in store, people want easy and intuitive experiences that cater to their needs.

When it comes to payments, consumers have increasingly turned towards payment methods that allow for quick and secure transactions depending on the context.

As merchants and payment companies responded to these trends, digital wallets and other alternative payment solutions, including contactless methods, became more common.

Then COVID-19 hit and these trends were greatly accelerated. “We find in these days of social distancing, convenient and contactless payments are certainly at the forefront,” of both consumers’ and merchants’ minds, explained Pucci.

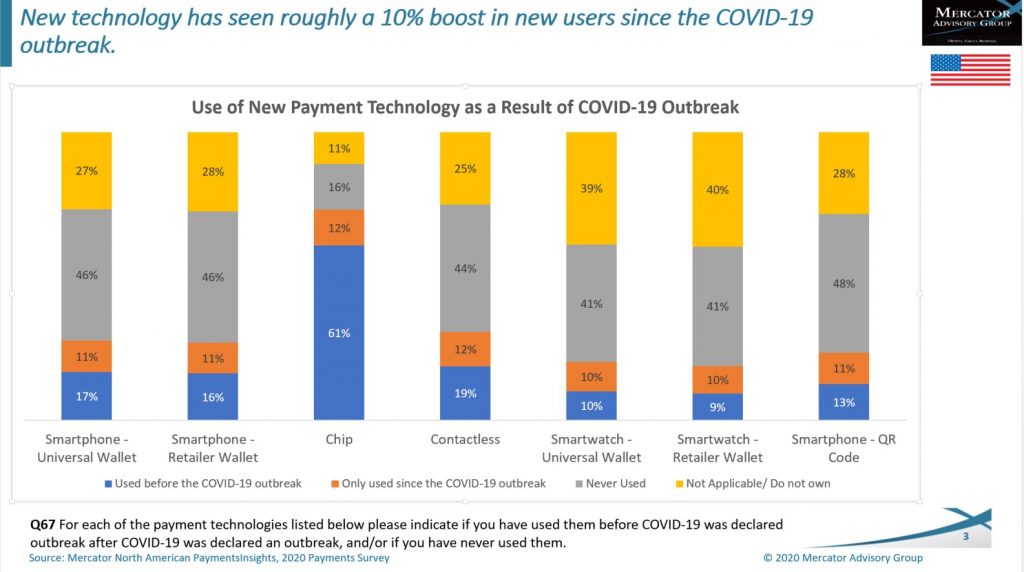

Since the pandemic began, new payment technology has seen nearly a 10% boost in new users, according to Mercator Advisory Group’s North American PaymentsInsights 2020 Payments Survey. New payment technology includes products ranging from QR codes to digital wallets.

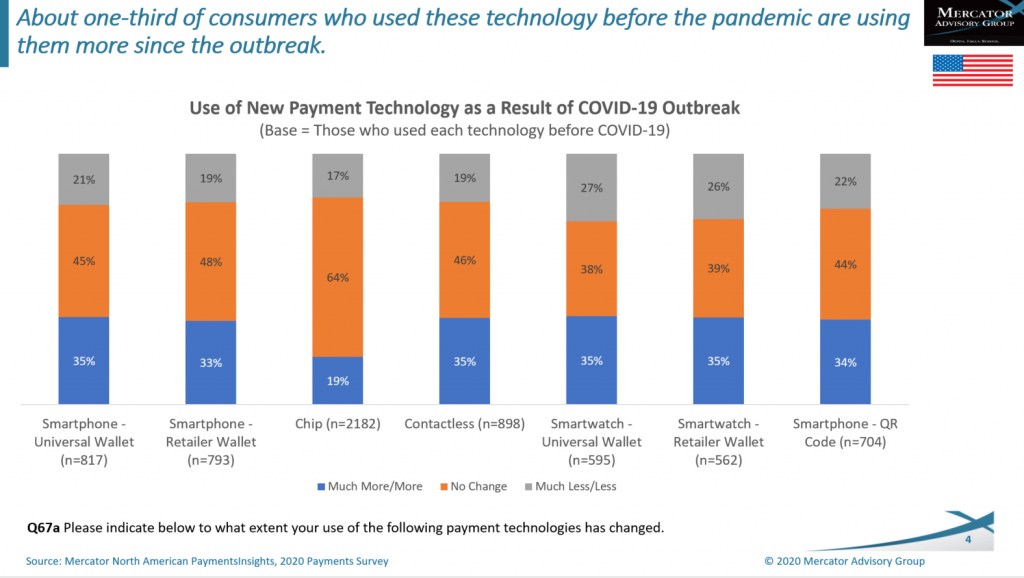

At the same time, those who were already using these products have reported doing so more often. Mercator found that nearly one-third of consumers “who used these technologies before the pandemic are using them more since the outbreak.”

All this underscores the fact that consumer expectations around payment methods, which were already changing before COVID, are shifting even faster—and merchants need to keep up.

Already used around the world, QR codes are on the rise in the U.S

Paying for goods and services using a QR code may seem uncommon to an American, but this payment method is already fairly common overseas, especially in Asia and developing countries around the world.

In China and Japan, for example, QR codes processed $1.65 trillion in purchases in 2016. The high transaction volumes makes sense when one considers that, in China, an estimated two out of three consumers use the technology. QR code use in India is also widespread.

Now QR codes are becoming more popular in the U.S. Mercator’s data show that while only 13% of consumers used QR codes on their smartphones prior to the pandemic, an additional 11% have used the technology since. Moreover, 34% of those who were already using this payment technology reported using it more since COVID began.

“COVID-19 really jump started more adoption,” said Lee, noting that for merchants looking to accommodate consumers’ desire for secure, touch-free payment methods, “QR code payments are readily available.”

Pucci agreed, adding that “it’s imperative for retailers to get in on the game here, so to speak, because more and more consumers are going to be looking to make contactless payments.”

QR codes allow merchants to accept more payment methods and promote customer engagement

Merchants have a lot to gain by supporting QR code payments. “The most immediate benefit is the ability to accept new payment methods,” said Lee. Many companies, including PayPal and AliPay, provide customers with apps that allow them to make purchases using QR codes. By offering QR code payment capabilities as well, merchants can transact with more customers.

But the benefits of QR codes extend well beyond just being able to accept more payment methods. “This technology really enables data driven personalization,” explained Lee. “It can really enhance engagement with the customer.”

By using bucket history and user information gleaned from QR code use, merchants can automatically tailor offers to customers. “We can really engage consumers through personalized offers and messaging that can be embedded in the QR code,” said Lee.

This could be done as part of a merchant’s rewards program to drive engagement and revenue. “The higher the engagement, the more you’re encouraging consumers to come in and spend,” explained Pucci.

He noted that merchants in the C-store and QSR verticals are already reaping the benefits of improving their rewards programs by better utilizing emerging technologies.

Finally, both Pucci and Lee highlighted the fact that QR codes can be scanned through Plexiglas, which is important as more merchants install barriers to protect their employees and customers alike.

Few barriers exist to implementing QR code payments

One of the biggest draws of barcode payments is that merchants can offer it without much difficulty. This payment technology does not require merchants to invest in expensive hardware or software upgrades.

“Equipment-wise, it’s using the same scanners merchants use today to scan a traditional 1D barcode or two-dimensional scanner,” said Lee. “So as long as they have one those devices, which most retailers would, they should not have much of a barrier.”

Another concern revolves around consumer education. Since many U.S. consumers are not familiar with QR codes, merchants will have to teach people how to use this payment method and why doing so is worth it.

However, Pucci and Lee explained that the consumer education piece is not as much of a barrier as it may seem. As has been discussed, many consumers have already encountered QR codes due to COVID-19.

Throughout the country, for example, it’s now common to use QR codes to access the menu at restaurants. This means that “some of the barriers of consumer education are starting to fade away,” said Lee.

Another concern relates to personal data. Since transactions via QR codes can be so information rich, there is a fear among some merchants that handling this data can be risky and expensive. But this, too, is not an insurmountable barrier.

“One of the ways that we’ve gotten around that is by using tokenized account numbers,” said Lee. “So there’s no PII data that’s being transmitted from the point of sale through to the providers.”

Merchants should look for the right provider

If a merchant wants to offer QR code payments to its customers, it should be sure to partner with the right payments provider.

“You want to partner with someone who’s going to give you multiple payment options through a single integration,” explained Lee, noting that this is the approach offered by InComm, made possible by a series of high-profile partnerships.

In 2018, InComm became the payment processing partner of AliPay, thereby allowing its merchants to transact with AliPay users. InComm then partnered with PayPal to bring touch-free payments to a variety of U.S. retailers, including CVS. As a result, once a merchant connects to InComm’s payment switch, they are then “connected to a multitude of payment providers on the back end, including the leading wallets in the world,” said Lee.

Merchants should also look to partner with a company that makes the payment process as easy as possible for consumers. For InComm’s part, its solution is designed to be as easy to use as possible. “We say it’s as simple as one, two, three, four,” explained Lee:

- Ring up your purchase

- Have your mobile device ready for payment

- Wait seconds for the transaction to happen

- Receive a confirmation on your mobile device

Using QR code payments is that easy regardless of whether the payment type is PayPal, AliPay, or any of “the other payment types that are coming right behind it,” concluded Lee.