October 9, 2018//-Increasing and improving the cooperation between multinational development banks (MDBs) has been recognised as a major step towards achieving the Sustainable Development Goals(SDGs), which were adopted by world leaders in September 2015 at an historic United Nations (UN) summit.

Today, in a key step towards facilitating this joint effort, and as part of their commitment to the ‘Billions to Trillions’ agenda, a group of MDBs are publishing a new harmonised framework for assessing additionality in their fully integrated private sector operations.

MDBs provide services that are additional to those provided by private markets, acting as both commercial and development entities.

They invest principally on a commercial basis in projects that are expected to meet high financial, procurement, economic, sustainability and governance criteria standards.

As public entities with development mandates, they step in to support rather than compete with the market.

The concept of additionality captures the premise that the use of MDB resources should be limited to interventions to support private sector operations that make a contribution beyond what is available in the market and should not crowd out the private sector.

Additionality is already a central principle for MDBs working in the private sector, and is one of the five common principles that MDBs endorsed in 2012 to guide their engagement with the private sector to achieve development goals.

With the EBRD’s private sector focus, additionality has always been a guiding principle in the selection and design of investment projects. For MDBs that are increasing their work in the private sector, the new joint framework will help guide engagement with the private sector to achieve development goals.

The new MDB Additionality Framework provides concrete guidance on the application of the additionality principle.

The framework includes: more detail on the principle of additionality; common definitions for financial and non-financial additionality; guidance on a common approach to the governance of additionality; and examples of types of evidence that help demonstrate the presence of additionality.

While recognising the assessment of additionality is context specific for each project within each MDB’s mandate, a harmonised approach will allow for a more effective and efficient conversation with shareholders on where and how to intervene to ensure that MDBs’ resources are used in the most catalytic manner possible and that they are directed where they are most needed, ultimately supporting the delivery of the 2030 Agenda for Sustainable Development.

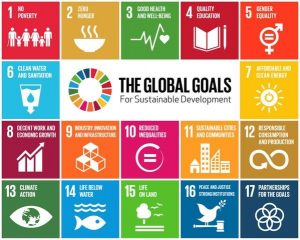

The 17 SDGs constitute the 2030 Agenda for Sustainable Development which aims to end all forms of poverty, fight inequalities and tackle climate change, while ensuring that no one is left behind.

To meet the investment needs of the SDGs, MDBs joined forces in 2015 by adopting an action plan under the name “From Billions to Trillions” which aims to mobilise private sector contributions together with the work of international financial institutions.

The concept of additionality is one of the guiding principles of the EBRD. Established in 1991, the Bank works to strengthen the private sector in the economies where it invests.

In its operations the Bank is also guided by the requirements that its investment must be commercially viable (“sound banking”) and contribute to economic reform (“transition impact”). To date, the EBRD has invested more than €125 billion through more than 5,000 projects in across three continents.