Global investment remains weak as a second wave of Covid-19 infections hit large parts of the northern hemisphere in November, although the recent digital boom has translated into protracted strong activity in the communications industry across geographies.

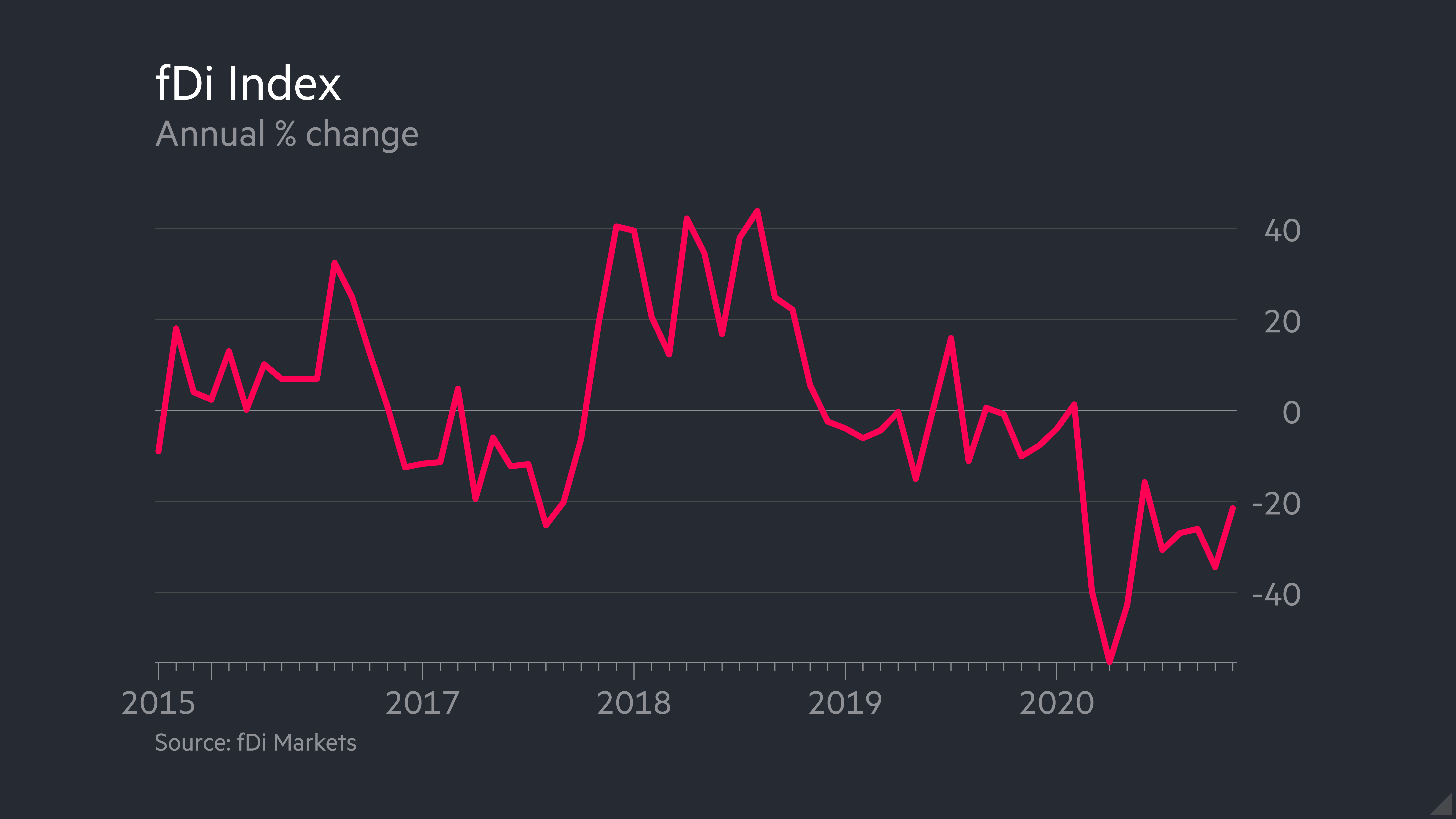

The fDi Index — which tracks foreign investors sentiment — stood at 790.8 points in November, down by 21.5% from the same month of 2019, according to figures from greenfield investment monitor fDi Markets.

The slump would have been worse if it had not been for the handful of sectors bucking the trend, first and foremost the communications sector, which includes telecommunications and internet equipment and infrastructure.

Foreign investors in the communications industry announced projects worth an estimated $10.1bn in November, the strongest monthly performance since November 2015, according to fDi Markets figures.

Investment activity in the sector is up by 34.2% between January and November from the same period of 2019, according to fDi Markets figures, making it one of the few sectors that have been able to buck the Covid-induced slump — the others being consumer products, particularly nonstore retailers (e-commerce), and biotech.

India alone captured communications projects worth $4.2bn in November, as foreign investors try to compete with domestic players for a piece of the country’s fast-growing digital economy.

Amazon Web Services (AWS) announced plans to set up a cloud region in Hyderabad, at an estimated capital investment of $2.77bn. The country has also been on the radar of telecommunications equipment manufacturers as they diversify their production matrix away from China.

In November, the country’s minister for IT and communications, Ravi Shankar Prasad, said that nine of Apple’s 11 manufacturing units producing iPhones in China had been shifted to India.

But India was not the only country to record landmark investment projects in November. The month saw the largest foreign investment project ever announced in Paraguay as Paracel, a pulp producer and subsidiary of Sweden-based Girindus Investments, announced a $3.2bn investment to construct a pulp mill in the city of Concepción, fDi Markets figures show.

November also saw renewed investment activity in the automotive industry after months of relative quiet, as the pandemic paused investment plans of automakers across the globe.

German Volkswagen set aside $1.18bn to expand an existing plant in Bratislava, Slovakia, which replaces previously cancelled plans to open a new facility in Turkey. Scania, the Volkswagen-owned truck producer, and Ford also announced major investment projects in China and Mexico, respectively.

With the rise of electric mobility, battery producers are also expanding their international footprint. Chinese Contemporary Amperex Technology (CATL) announced a $5.1bn manufacturing plant in Indonesia, the largest foreign investment project ever in the production of batteries for electric vehicles, according to fDi Markets data.

Elsewhere, Italian energy producer Enel has announced plans to invest €17bn in renewable energy production in the 2021–2023 period, fDi Markets data show.