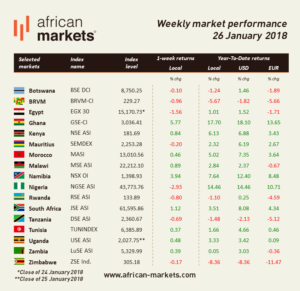

January 29, 2018//-It was a mixed performance on African markets this week with NGSE leading the weak performers as hints of political tensions are entering the economic debate.

This weeks closed the January MPC meetings with little surprise other than Ghana maintaining its rate unchanged.

Due to the inability to reach a quorum, the monetary policy meeting did not take place this week in Nigeria. Consequently, interest rate was maintained at 14%. In parallel, Emefiele, Nigeria’s central bank Governor told a newspaper that interest rates could potentially be cut by July. The NGSE lost 2.93%.

In Zimbabwe, it seems that the stock exchange is no longer the refuge sought be investors against hyperinflation as level has come down. The ZSE Ind. lost 0.17%.

President Mnangagwa declared at Davos that the country’s priority would be to pay off the government’s debt arrears and has been on a trip to rebuild confidence around the country.

Ghana kept interest rate unchanged at 20% in order to contain inflation. The GSEis continuing its strong performance of last year and gained 5.77%.

The IMF mission for Egypt announced this week that GDP growth rate expectations for this fiscal year reached 4.8% from 4.2% last year. This results from the macroeconomic stabilisation policies the country put in place last year among which the exchange rate liberalisation.

In December, inflation decreased to 21% from 33% in July 2017 and expectations for this year are for inflation to further come down and reach the low teens.

The decelerating inflation should enable the central bank to cut rate very soon and boost growth. The current account deficit has lowered, reaching its smallest shortfall in 3Q17 thanks to tourism revenues, worker’s transfers and solid exports. Fundamentals look on track for a sustainable recovery. The EGX30 lost 1.56%.

Njoroge, Kenya’s central bank Governor reiterated this week his view that the cap on interest rates were weighing on the economy. While growth certainly came lower than expectations last year, the jury is still out on whether this was due to political tension and drought only or whether deceleration was reinforced by interest rate caps.

As a reminder, since September 2016 the government has capped interest rates to 4% above the central bank’s benchmark rate. Njoroge still expects growth to accelerate to 6.2% in 2018. The NSE gained 0.84%.

South Africa’s Finance Minister Malusi Gigaba stated this week that the government would not support the financially-ill state-owned electric company, Eskom. As I argued previously, finding a solution for Eskom is key for the country’s investment case. South Africa needs reforms to achieve sustainable growth and one of it comes in the form of fiscal discipline.

Gigaba’s view thus supports the need for fiscal discipline. Options are limited should the country not intervene and finding private buyers may prove difficult however probably not impossible. The JSE added 1.12%.

african-markets.com