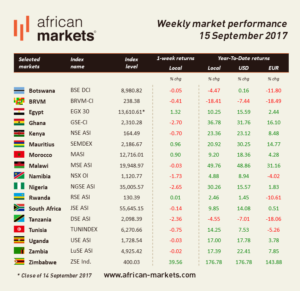

September 19, 2017//-Sentiment was on the bearish side on African markets this week. Most indices under our watch closed on negative territories with the Zimbabwean stock exchange being the exception that proves the rule.

The ZSE more than make up for the poor performance of its peers. The ZSE is the best performer of the week and of the year.

The ZSE hit a record high this week. It reached its highest level since 2009 when Zimbabwe moved to using the US dollar. Foreign exchange shortage has propelled businesses and individuals struggling to access cash from banks to reach for the equity market as a way to maintain the value of their money. The rally is being driven by stocks such as Delta Corporation, Padenga and telecoms firm Econet Wireless which shares have more than doubled in value this year. The ZSE gained 39.56%.

The NSE lost 0.70%. Fitch rating agency stated that its negative outlook on Kenya’s sovereign debt could be changed if a re-run presidential election goes “relatively” smoothly and debt to GDP levels were to decrease. The new election opposing current president against opposition leader Odinga has been scheduled for 17th October. Fitch currently rates Kenya as B+ with a negative outlook.

KPMG fired top executive members of its South African branch after an internal investigation found that work done for the Guptas improperly influenced government contracts. South African chief executive Trevor Hoole, chairman Ahmed Jaffer, chief operating officer Steven Louw and five senior partners all resigned. This is the third firm to suffer the consequences of work done for the Guptas after public relations agency Bell Pottinger and consultancy McKinsey. The JSE lost 0.14%.

Zambia’s Ministry of Finance provided economic forecasts this week. The economy is expected to grow by 5% in 2018, 5.1% in 2019 and 6.1% in 2020, up from 4.3% in 2017. Inflation is expected to remain 6 to 8% from 2017 to 2020. The LuSE lost 0.02%.

As part of a measure to increase financial stability, Ghana’s central bank has raised the minimum capital required for banks 400 mn cedis ($90.2 million). The previous capital requirement for banks and new entrants was 120 mn cedis. The increases took effect from September and that the banks have up to the end of 2018 to meet them. The GSE lost 2.7%.

africanstockmarkets.com