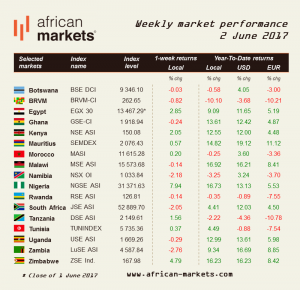

Another mixed week on African markets with the light of the week coming from the strong performance of the Nigerian Stock Exchange (NGSE). The rally in the benchmark shows a more bullish stance by investors as they are slowly but surely starting to come back. The NGSE is now part of the top three top year-to-date performers in local currency.

Nigerian shares rose boosted by gains in banking and cement sectors as low valuation for some commercial bank shares result in positive risk-reward asymmetries. First Bank Holdings rose 10% as sentiment is improving on Nigeria with increasing expectations that the country would be off recession soon as higher oil revenues are leading to a steadier currency. It indeed seems that central bank injections of dollars in the foreign exchange market to improve liquidity are starting to pay off as the currency is stabilising. The NGSE gained 7.94%.

In Tanzania, the finance minister lowered the GDP growth expectations from 7.4% to 7.1%. Further explanations for the reasons behind these lower forecasts were not provided as this announcement comes after the anti-corruption drive that took place last week. Mpango also announced that the inflation was expected to fall to 5% next year. The DSE gained 1.56%.

As widely expected, the central bank of Kenya kept its benchmark rate unchanged at 10% to lessen the threat of demand-driven inflation. The government is fighting high inflation, caused mostly by higher food prices. The country’s inflation reached 11.48% in April, far away from its target band of 2.5% to 7.5% and up from 10.28% the previous month. The NSE gained 2.05%.

South Africa’s unemployment rate numbers came out and they are not great. Unemployment increased to its highest level in 14 years in the first quarter as agriculture and informal sectors cut jobs and more people quit looking for employment. 27.7% of the labour force was unemployed in the first quarter up from 26.5% in the last quarter of 2016.

Domestic product results are expected next week and should they show a contraction the country could fall in a technical recession following a first contraction of the economy in 4Q16. The JSE lost 2.05%.

According to the Uganda’s Treasury, the country is expected to witness its second lowest growth rate in 20 years at 3.9%, following the drought that has affected large parts of the country resulting in lower agricultural output. Treasury has had had to revise down the GDP forecasts from the expected 5% due to the huge crop failure and low livestock productivity. The agricultural sector employs around 70% of the population and contributes to 26% of the GDP. The USE lost 0.29%.

Africanmarkets.com