Weekly Market Commentary

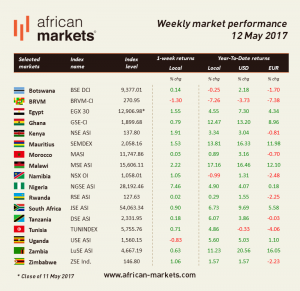

This week marks another positive week for African markets as most markets ended on green territories.

Nigeria’s lower and upper parliamentary chambers passed the 2017 budget, set at 7.44 tn naira ($24.4 bn). According to lawmakers, the budget assumes an oil price of $44.5 a barrel and foreign borrowing of 175.9 bn naira and domestic borrowing of 1.488 tn naira. In other news, Moody’s Investors Service maintained its stable outlook on the Nigerian banking system, reflecting the rating agency’s view that acute foreign-currency scarcities will progressively ease, though loan risks will remain high. The NGSE gained 7.46%.

Following similar moves by the National Bank of Egypt and Commercial International Bank, Egypt’s second biggest bank lifted restrictions on customers’ overseas credit card purchases while keeping restrictions on foreign-currency cash drawings. This signals that the foreign-exchange issues the country has been dealing with are coming to an end. As investors came back since the Egyptian pound floatation, Egypt’s net international reserves have risen to their highest level in six years, while overseas holdings of Egyptian government debt have roughly tripled. Currently is battling high inflation, the fruit from a weaker pound. The EGX30 gained 1.55%.

The NSX gained 1.05%. Namibia’s Finance minister stated this week that the country has secured a 10 bn Namibian dollars ($750 mn) loan from the African Development Bank to finance its budget deficit and infrastructure projects. Namibia’s budget deficit is expected to narrow to 3.6% of GDP in the current fiscal year from 6.3% in the previous year. This comes as the government is facing a severe liquidity crisis that has resulted in budget cuts, as well as liquidity constraints in the domestic market, characterised by persistent undersubscription of government debt instruments.

Fitch ratings agency upgraded Ghana’s outlook to stable and believes the government is making progress in stabilising the economy after a period of crisis. Fitch kept its ‘B’ rating on the gold, oil and cocoa producer, but said it expected a revival of GDP growth and a decline in inflation and the budget deficit. The GSE gained 0.79%.

Africanmarkets.com